Table of Contents

From surging inflation and rising rates to the war in Ukraine, U.S. endowments, foundations and healthcare investors face a challenging investment landscape with complex macroeconomic conditions.

Historic market drawdowns and mounting macro risks are driving U.S. non-profit investors to increase private equity allocations as a means of generating much-needed returns. Meanwhile, although ESG adoption remains on their radar, many investors are taking a wait-and-see approach in terms of the implementation of practices and strategies.

To better understand how these investors are approaching this new terrain, BlackRock partnered with Coalition Greenwich to conduct a research study of U.S. endowments, foundations and healthcare investors’ priorities. A total of 87 U.S.-based investors, including 31 endowments, 31 foundations and 25 healthcare systems, completed a 38-question online survey between early February and late March 2022. The online survey was complemented by in-depth phone interviews with CIOs and senior decision-makers at six large institutions.

Even before recent rate hikes by the U.S. Federal Reserve Bank accelerated the market downturn and worries about a recession, mitigating macro risk was the top priority for investors in the study, with inflation, rising interest rates and drawdown risks cited as primary factors. Russia’s invasion of Ukraine amplified these macro concerns. The portion of study participants who said navigating higher inflation was a top investment objective rose by 11 percentage points after the invasion, while the percentage calling rising rates an important investment concern increased by eight points. The number of respondents who said reducing drawdown risk was a low priority fell from 1 in 5 to just 1 in 16.

As investors position their portfolios for these risks, they favor real estate, public equities, inflation-linked bonds and natural resources to address inflation, and value stocks, real estate and floating-rate debt to position for rising rates.

Retaining a Risk-On View

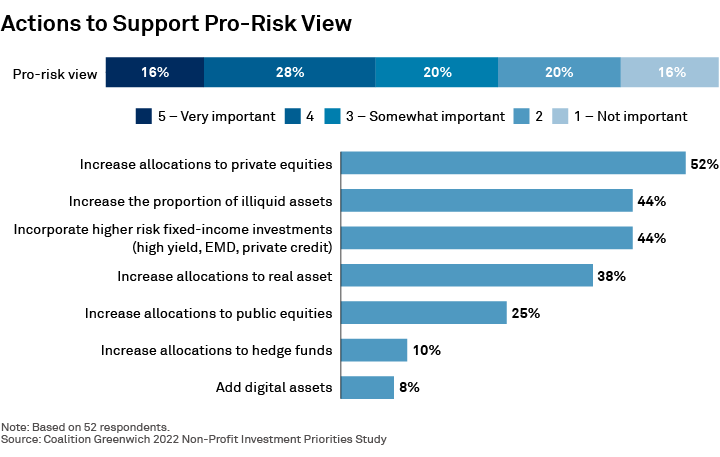

Fears of a major drawdown have not caused these investors to abandon risk, however. Despite macro concerns, almost half of respondents remain focused on generating idiosyncratic returns and maintaining a risk-on view. More than three-quarters of investors in the study selected private equity as the preferred alternative asset class, with more than half increasing their private equity allocation to support a risk-on view. This reflects the segment’s increasing reliance on private markets to meet return objects in an environment where growth is becoming more scarce. The chart below outlines the asset classes in which risk-on investors are looking to add exposure.

A Cautious Embrace of ESG

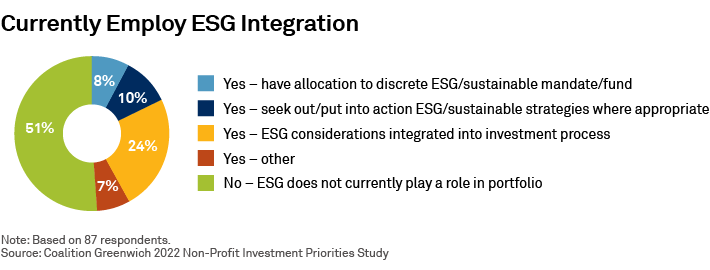

Nearly half (49%) of the institutions surveyed have adopted environmental, social and governance (ESG) strategies in their portfolios. For these investors, the primary goals of their ESG initiatives are to generate a positive impact, enhance investment returns, and satisfy stakeholder demands and corporate standards. By far the most popular strategy for achieving those goals is to incorporate ESG factors into the investment process, a holistic total-portfolio approach preferred by more than three-quarters of the investors. Tactically adding sustainable investing and impact investing strategies are also appealing. Negative or exclusionary ESG screening is the least-popular approach.

While ESG adoption will continue to command attention throughout the non-profit segment, some investors are reserving judgment. Of the investors who do not currently employ ESG, almost one-quarter plan to adopt the approach within the next five years. However, 38% of this group do not have such plans, citing challenges with implementation and incorporation. The remaining 39% are unsure of their future ESG plans. These institutions might be looking for more conclusive data that demonstrates ESG factors can generate long-term outperformance.

U.S. endowments, foundations and healthcare investors have many obstacles to navigate in the current environment. Macro developments have pushed investors to try to mitigate interest rate and inflation pressures, while simultaneously pivoting to alternative or higher-risk asset classes to generate return. While ESG adoption is expected to increase in the next five years, there are still some hesitations on what direction to take.

Further information on this research can be found here.

MKTGH0722U/M-2307024