Table of Contents

Over time, the market has come to embrace cloud in more and more aspects of trading technology. Processing large sets of data and calculation of computationally intense formulas (or both) are common uses of cloud. While the market may not be quite ready to move every part of the trading cycle to the cloud, market data is becoming more and more mainstream.

Market Data + Cloud Solutions

In fact, somewhat ironically, market data is very fertile “ground” for cloud offerings. Not only are third-party cloud providers continuing to enhance their market data offerings (i.e., Bloomberg,[1] Refinitiv,[2] Xignite[3]), but exchanges are also offering access to data directly via their own cloud services or innovation partners (e.g., CBOE,[4] IEX,[5] Nasdaq[6]). In a post-COVID-19 world, cloud has only become more entrenched in the trading lifecycle across both buy-side and sell-side firms. Even looking back to views from 2019, the growing importance of cloud servicing market data needs is clear.

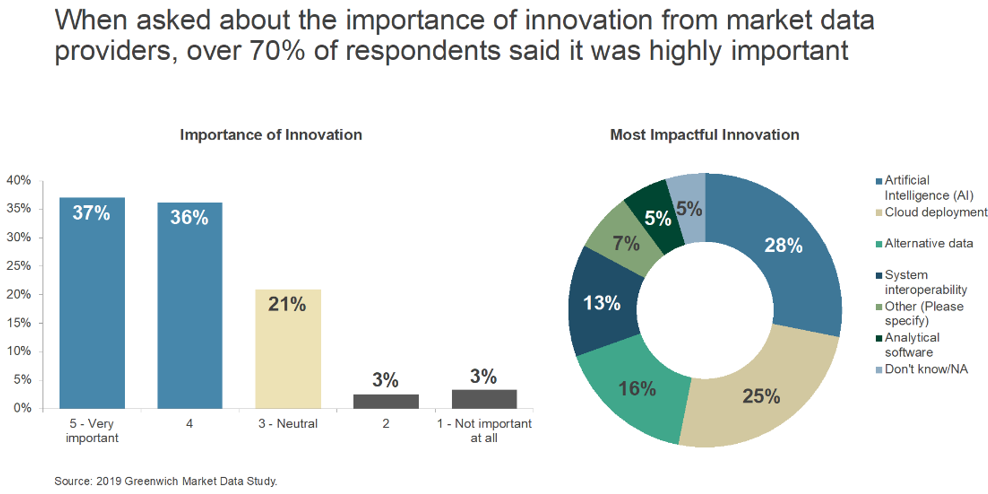

In fact, almost three-quarters of respondents in our 2019 Market Data Study[7] identified innovation in market data as highly important, with cloud seen as the second most impactful innovation (trailing only slightly behind artificial intelligence).

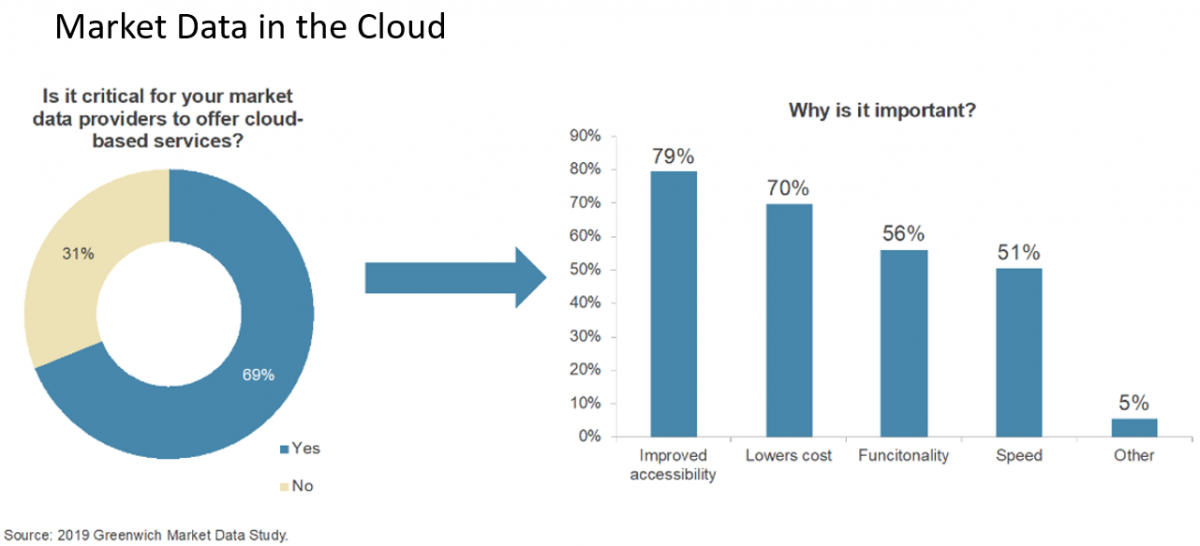

Furthermore, just shy of 70% feel it is critical that their market data provider offers a cloud-based solution. Cloud is important for many reasons, including improved accessibility, lower costs and increased functionality.

Concerns About Security

If cloud is so important and offers such benefits, why isn’t it used more widely when it comes to market data? Our respondents again gave a wide range of responses: Cost and complexity of the transition, latency, and data quality were all cited. But the most significant roadblock to further adoption is security.

It is no surprise that security of cloud is concerning to the industry. After all, cloud breaches routinely make headlines, and 2019 was no exception. Events like Facebook’s Cultura Collective breach, Instagram’s Chtrbox account exposure and Capital One’s hack by an Amazon employee of sensitive information stored in Amazon S3 all heighten the industry’s focus on security when it comes to the cloud.

That said, when properly managed, configured and maintained, security in cloud is at least as secure, if not more so, than security in a traditional data center setup. One way this can be seen is by how U.S. regulators are increasingly large users of commercial cloud computing offerings. And while financial services firms are top notch at managing their data centers, the large tech companies such as Amazon, Microsoft and Google stake their entire business—not to mention their reputation—on ensuring their data centers and the cloud they power are safe and secure.

Trusting Cloud for the CAT

For example, the Consolidated Audit Trail (CAT) is being hosted in AWS (Amazon Web Services). Built by FINRA CAT LLC, the CAT will be the largest repository ever collected of market data, order data and customer data in equities and options. CAT will use Amazon Aurora (for its primary database needs), Amazon Redshift (for data warehousing), and Amazon Simple Storage Service (Amazon S3). The CAT will also leverage AWS security capabilities such as AWS Key Management Service (KMS), Amazon GuardDuty, and AWS CloudTrail in order to ensure the security of sensitive financial data.

Of course, with any such large collection of data, there are concerns about vulnerability.[8] Even for firms that are “just” using the cloud for access to or processing of market data, security will always be a critical priority. Even when using the biggest, most sophisticated players, security is always a shared responsibility between the user and the provider.[9]

Other Considerations for Migrating to Cloud

Other areas of concern for firms considering a migration to cloud-based market data are costs of transition and complexity of transition. For firms that have a deeply entrenched market data system, a wholesale migration to cloud market data usage requires thoughtful planning and proper expertise. The third-party providers and cloud providers themselves have deep benches of experts to help in these types of planning and implementation exercises. The upfront cost can be hard to swallow, though, especially for public companies which must focus on quarterly results. However, the long-term cost saving opportunity is increasingly hard to ignore.

Speed and latency are also areas that get a lot of attention. When dealing with human reaction times (e.g. data terminals, retail trading apps, non-ultra-low latency trading), cloud-based market data has proven to be up to the task. At present, ultra-low latency trading applications are not a perfect fit for cloud market data and do still require direct connections with the data sources. But some firms whose electronic trading is not hypersensitive to latency have experienced great success with cloud-based market data.

Looking Ahead

The rate of change of technology is nothing less than astonishing. No crystal ball can predict what revolution may be just around the corner. Whether a revolution in cloud multi-cast, network topology advancements, or some other yet undeveloped technology, it is clear that cloud’s relentless drive forward will eventually lead to a future where even ultra-low latency trading “takes root” in cloud’s fertile offering.

[1] https://www.bloomberg.com/professional/product/market-data-cloud/.

[2] https://www.refinitiv.com/en/financial-data/market-data/real-time-data-feeds/real-time-cloud-data.

[3] https://www.xignite.com/.

[4] https://markets.cboe.com/us/equities/market_data_products/spotlight/.

[5] https://iexcloud.io/.

[6] https://www.nasdaq.com/solutions/cloud-data-service.

[7] From July to September of 2019, Greenwich Associates electronically surveyed 129 respondents.

[8] https://www.pionline.com/regulation/cat-begins-without-hitch-security-worries-persist.

[9] See, e.g., https://aws.amazon.com/compliance/shared-responsibility-model/.