Table of Contents

As we share with you our fourth weekly Pandemic Perspectives blog, there are tentative signs that the spread of the COVID-19 virus is plateauing, with the increase in new infections no longer following an exponential curve. Market volatility has come down in tandem but while no longer at the exceptional levels observed mid-March, is still elevated.

Time, then, to make an initial assessment of how well asset managers have been able to serve their institutional clients through this exceptional period of market dislocation that has caught most of us by surprise.

Leaders Emerge at Times of Crisis

The COVID-19 crisis should remind asset managers of the old adage, “Never let a crisis go to waste.” Over the past decade, market volatility has mostly been low and, in an immensely competitive industry, it has often been difficult for asset managers to provide distinguishing levels of service.

The coronavirus pandemic has changed this entirely, providing a huge opportunity for asset managers to set themselves apart in the way they service clients when their investment portfolios, workplace arrangements and often their private lives are subject to completely unexpected changes. This leaves them well positioned to win additional business and gain market share once the world undoubtedly overcomes this crisis.

The best performing managers during the crisis – such as PIMCO and AllianzGI – demonstrate that a culture committed to service excellence optimally positions such firms to really excel in their clients’ eyes in times of crisis.

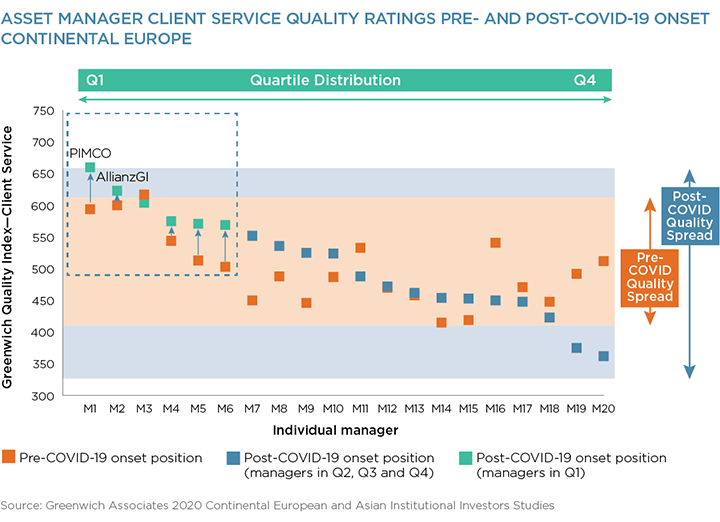

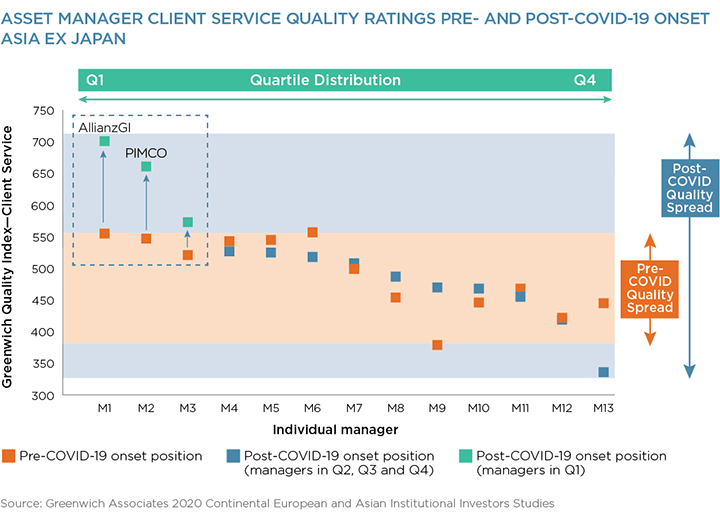

As shown in the charts below, the change in feedback from institutional investors in Continental Europe and Asia about the perceived quality of service from their respective asset managers reflects this. Between the periods prior to March 1st – when COVID-19 had not yet made a genuine impact on markets and most people’s lives – and after March 1st, the spread in the Greenwich Quality Index for Client Service widens dramatically, illustrating the increasing difference in perceptions from the best to the worst performing managers. (We chose a cut-off date of February 16th in Asia since the coronavirus crisis arguably made itself felt earlier there than in Europe.)

A similar pattern is also visible in the U.K. market, with a widening spread in client perceptions of service quality pre- and post-COVD-19 onset.

The Greenwich Quality Index for Client Service is derived from client evaluations of asset managers’ service quality along such metrics as understanding of clients’ goals, reporting quality and ability to support clients with intellectual capital and insights. The interviews took place primarily during Q1 2020, allowing us to divide the feedback into pre- and post-COVID-19 datasets.

Chance Favors the Prepared Mind, and Opportunity Favors the Bold

While this famous quote by French microbiologist Louis Pasteur has relevance for the preparedness of health services around the world dealing with a virus pandemic, it also has similar implications for asset managers’ business.

First implication - client service: the analysis of the increasing heterogeneity in asset manager client service levels with the onset of the crisis shows that many managers that truly excel in their clients’ eyes are firms that exceled in client service prior to the crisis.

In Europe, the correlation coefficient between pre- and post-COVID-19 Greenwich Quality Index scores is a moderately strong 0.6 and in Asia it is even 0.7. This means that in order to be able to excel in client service at times of crisis, it helps if an asset manager already has a proven culture of service excellence prior to the crisis.

Nonetheless, it also reveals that some asset managers have genuinely been energized by the crisis. The asset managers denoted in the European graph by M7 and M9 have made a big jump in service quality, illustrating that some organizations need a wake-up call to really demonstrate to their clients what they are capable of. Once the market environment enters again into calmer waters, they should ensure that the lessons learned from this crisis on service excellence are institutionalized so that their organizations do not fall into the “business as usual” service routine.

Regardless of whether a manager has entered the crisis with an already excellent service platform or has leveraged the crisis to transform the service culture, the patterns emphasize the need for a consistent focus on service excellence with clear-eyed willingness to benchmark service quality to competitive standards (as opposed to often self-serving client satisfaction research endeavors).

Second implication - IT infrastructure: a highly resilient and scalable IT infrastructure has rarely been so valuable, not only for portfolio management and operations but also for frontline client-service professionals.

A person at a European asset manager whose client service professionals have smoothly conducted portfolio reviews from the comfort of their living rooms says he no longer questions his firm's robust IT spending. A California-based firm already had most of its staff work from home simultaneously once a month as part of business continuity preparation for a major earthquake – an exercise that also allowed for a smooth transition toward work from home for the entire organization.

On the flipside, no firm committed to service excellence in normal times has been able to provide nearly adequate service levels if issues such as insufficient bandwidth, lack of user licenses for remote services, etc. prevented their staff to seamlessly work from home.

Conclusion

In asset management, the boldness that Louis Pasteur referred to is the commitment and resources required to build up an excellent client service culture and supporting IT infrastructure. For sure, this commitment will be rewarded with increased business and market share over the years following this crisis.