Table of Contents

As we make our way through April, the weather is warmer, work from home routines are in place, stimulus checks are “in the mail”, and the markets have started to recoup some of the losses from the initial period of shock and volatility.

Certain countries continue to operate in shutdown mode, while others are cautiously considering reopening parts of the economy as the number of coronavirus cases plateau and hospitalizations decline.

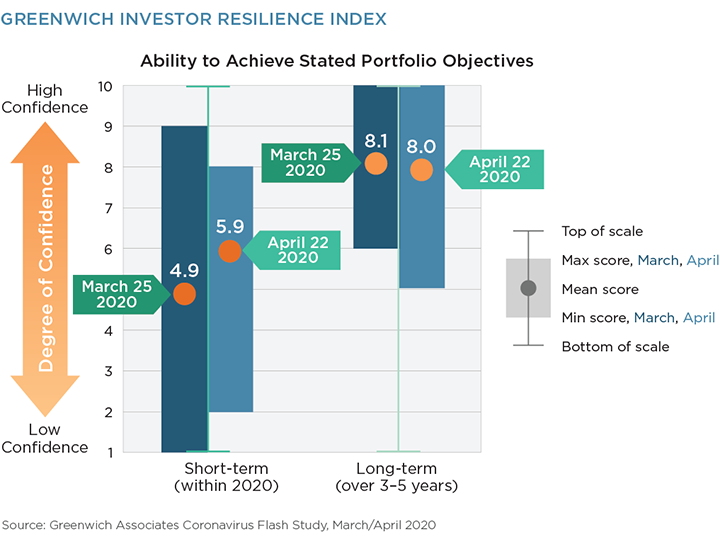

Investor outlook for the remainder of 2020 has improved modestly since late March, when we originally featured the Greenwich Investor Resilience Index in our first Pandemic Perspectives post, but only time will tell how quickly we are able to resume life that resembles some form of normalcy.

Be the Dr. Fauci of Asset Management

Now, more than ever, investors crave reliable sources of data and insights. Amid a seemingly endless stream of advice about how to wash our hands, when to sanitize our groceries and why to stop hoarding toilet paper, institutional investors seek the Dr. Faucis of the asset management world to provide them with thoughtful advice on the current market environment.

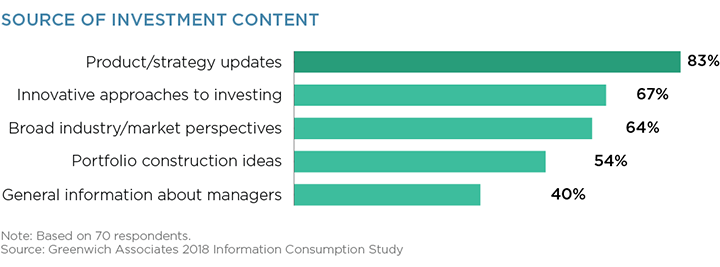

According to a 2018 Greenwich Associates study on investors’ information consumption habits, over 80% of institutional investors rely heavily on their asset managers for product and strategy updates.

The rapid economic decline caused by the coronavirus pandemic has also elevated expectations related to proactive communication between investors and asset managers, as well as the need for timely responses to investor inquiries. Developing the reputation of being a strong partner in times of crisis will pay dividends down the road – and, as we saw in Part 4 of this series, investing in service during good times prepares you to be a more trusted partner in bad times.

Actively Cultivating Loyalty

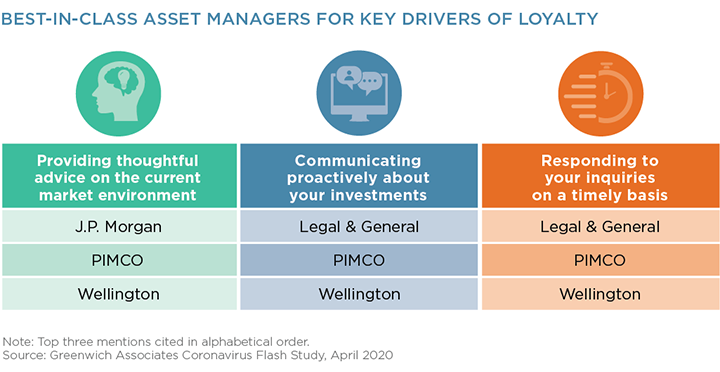

We asked institutional investors which asset managers are best-in-class when it comes to leading them through this challenging time. From the work that we perform in our Customer Experience Management (CEM) practice for financial services providers, we know that the following factors emerge as key drivers of loyalty during a crisis:

- Concern for a client’s needs

- Effective communication

- Timeliness of resolving problems

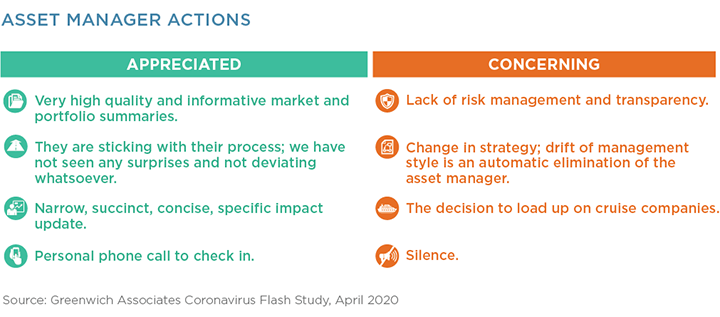

As you can see, these factors seem to be fairly intertwined, or at least linked, within the minds of institutional investors, as both PIMCO and Wellington received top three mentions across all three categories. When asked to qualify the actions that make asset managers stand out, investors emphasized the importance of personal outreach and high-quality market insights tailored to their portfolio.

Equally important to note are the factors that cause investors to lose trust in an asset manager during a crisis. Lack of communication is the most frequently cited reason. Changing investment strategy or showing a lack of investment process discipline will also put a manager in the penalty box.

Investors who trust their managers say they will tolerate lower returns but plan to perform post-crisis assessments.

Greenwich Investor Resilience Index

On March 25th, most of us were adjusting to the new normal and trying to figure out how to celebrate events and holidays via videoconference. At the time, the Greenwich Investor Resilience Index showed that investors’ belief in their ability to achieve portfolio objectives by year-end 2020 was already moderate—at best, demonstrating that short-term uncertainty had already set in.

Fast-forward three weeks. As of April 22nd, the Greenwich Investor Resilience Index shows a 20% improvement in the short-term outlook (moving from an average of 4.9 to 5.9), with the range of responses narrowing to a 7-point block (2 to 8).

The combination of the rising confidence score and more narrow range suggests that a degree more certainty may exist now after a month-long barrage of reports and news. The long-term outlook maintained a healthy score of 8.0, suggesting that the short-term pain is not yet impacting investors’ longer-term resilience in the face of major market (and societal) events.

Conclusion

In this new normal of social distancing and faced with an endless flow of updates and data from media outlets, outreaches from asset managers should be both timely and thoughtful.

As always, institutional investors value high-quality service and relevant, customized insights. Managers who have failed to deliver on these promises in the past are suffering the consequences even more now as investors weather this storm and expect their line-up of asset managers to form a solid foundation of advice and guidance.

Best-in-class managers (at least temporarily) are putting their sales pitches aside and using unprecedented shelter-in-place mandates as fodder to connect creatively – but still personally and proactively.

Part 1 – Greenwich Investor Resilience Index

Part 2 – Lessons from the Past

Part 3 – Supporting Consultants During Coronavirus

Part 4 – Asset Manager Service Quality: Pre- and Post-COVID-19 Onset

Part 6 – Useful Content in Times of Crisis