Table of Contents

While the word “unprecedented” gets thrown around quite freely, it is fair to say that the logistics and conditions around U.S. fixed-income trading over the past six weeks have been new to everyone regardless of experience.

Greenwich Associates gathered feedback from over 75 buy-side fixed-income investors in the Americas to learn more about the impact COVID-19 has had on markets, how dealers have responded and what the future holds.

Different Products, Different Levels of Partnership

Given the sheer magnitude of the disruptions to individuals, the real economy and the financial markets in March, no one was immune from the impact of COVID-19.

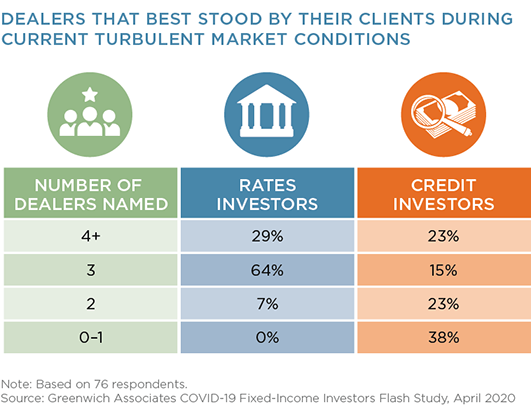

When we asked investors on an open-ended basis to name dealers that stood by them the most during the first several weeks of the crisis, it was striking that virtually all rates investors had at least three counterparties to highlight, while the response in flow credit was all over the map.

Dealers Response to Clients During the Crisis

When asked what actions in particular have been most helpful to buy-side firms, we were surprised by the feedback. Given the level of market volatility, we had expected that most would put dealers standing firm on their bids and offers at the top of the list. It certainly ranked high (particularly for rates investors), but not meaningfully ahead of a number of other factors, with just over 1 in 3 investors overall saying that standing by bids and offers is particularly helpful.

But perhaps in a sign that, despite advances in technology, fixed-income trading still requires significant human interaction, 42% felt that additional contact from their sell-side sales reps was most helpful.

Staying in Touch with Clients

In times of market disruptions, the impact of a decade or more of significant technology investments has certainly become clear. In the course of a few days, most financial services firms saw 90%+ of their workforce working from different locations, which would not be possible without the massive investments by firms across the industry.

However, those firms that have salespeople dedicating extra time to speaking with clients are those viewed most favorably. And, if you move beyond just additional sales contact, investors feel that additional contact from traders (32%) and research analysts (21%) is helpful as the buy side adjusts to the “new normal.” All told, two-thirds feel that hearing more from the sell side has been beneficial.

Anecdotally, we have also heard from the sell side that their salespeople have become that much more important to their trading desks during this period of volatility, helping to provide them better connectivity to clients when so many people are trading from home.

What Risks Are Investors Most Worried About?

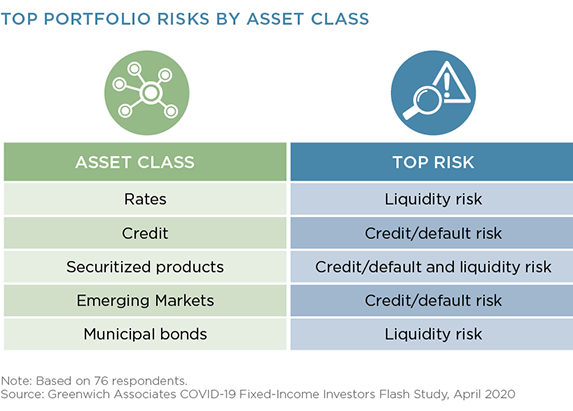

As the worst of the market disruption appears to be behind us, we wanted to understand what risks are still keeping the buy side up at night. With the amount of balance sheet dedicated to fixed income narrowing and the volume of trading increasing, liquidity risk is a top concern.

However, just as important on the minds of investors is credit/default risk. With the effects of the crisis rippling through the real economy, causing significant unemployment and GDP projections seemingly decreasing by the day, it is no surprise that investors are concerned about credit events impacting their portfolio.

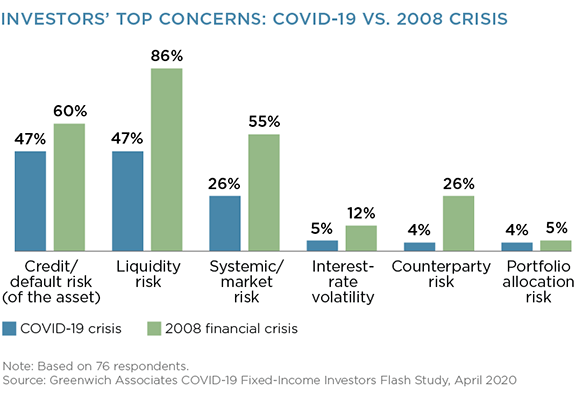

In thinking about the impact of COVID-19, we wanted to put it into the context of what concerned investors coming out of another marketwide event… the 2008 financial crisis. When we surveyed fixed-income investors about 10 years ago, liquidity and default risk were paramount. However, over half of investors were also concerned about systemic risk.

Given the regulatory and market structure changes that have taken place since the crisis, relatively few buy-siders are concerned that the impact of COVID-19 will negatively affect the functioning of the markets. At the same time, the concern that the current crisis will create counterparty risk is also far from the minds of investors, unlike in 2008, when 1 in 4 noted that they were still concerned about counterparty risk even three months after the fall of Lehman Brothers.

The Role of E-Trading: Helping or Harming Liquidity?

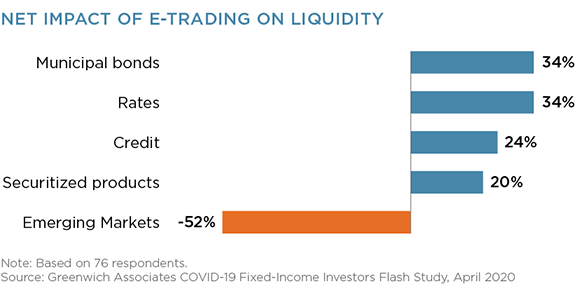

Even as many investors felt more comfortable speaking to a human during the peak of the market volatility in March, e-trading volume (as a proportion of total market activity), while down a bit, remained robust (Greenwich Associates tracks electronic trading trends as part of its Greenwich MarketView subscription).

By a nearly 2 to 1 margin in most asset classes, the buy side feels that e-trading has been a net positive to overall liquidity in the market; the one exception is emerging markets, where the majority believes that electronic trading negatively impacted overall liquidity in the market in March.

Looking Forward

As governments in the United States and around the globe shift their focus from solely containing the outbreak to identifying strategies for re-opening their economies, investors can slowly begin to exhale that the worst of the market volatility is behind them. When we look back on March 2020, it is clear that investments and market structure changes implemented over the past decade made a meaningful difference.

We expect that dealers who were and continue to be in front of clients, looking for ways to partner with them during the market turmoil, to reap the rewards and see more client flow over the coming quarters.