This week’s announcement of PacWest and Banc of California merging further stokes concerns around commercial bank stability and begs important questions about where we go from here.

Just last quarter, failures at Silicon Valley Bank and First Republic served as high-profile examples of what is at stake. However, concerns about the soundness of regional U.S. banks actually predated the SVB crisis. Executives’ confidence in commercial banks was off sharply in 2022, months before the troubles at SVB emerged.

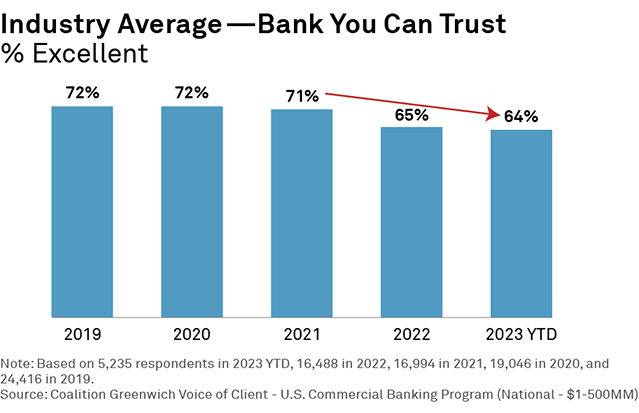

A combination of rapidly rising interest rates, credit risk exposure, industry consolidation, and a poor economic outlook last year caused many small businesses and midsize companies to start questioning the reliability of their banks. From 2019 to 2021, more than 70% of small businesses and midsize companies gave their banks top ratings for trustworthiness. In 2022, that share dropped to 65%. It dipped again slightly in the early months of 2023. We can only assume that trust levels will remain variable as uncertainty grips business owners.

Diminishing Trust

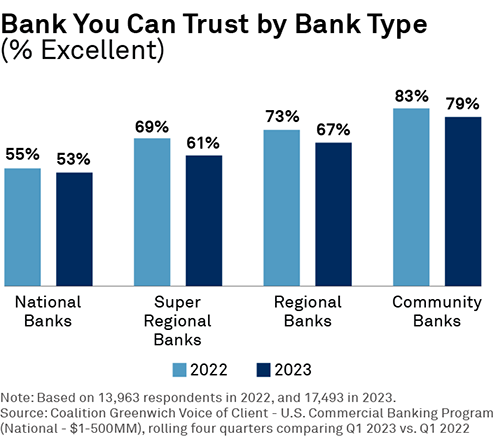

The decline in trust is particularly dangerous for regional and smaller banks. Small and regional banks face stiff competition from at least three sides. From within the banking industry itself, the top three U.S. banks are enticing both retail and commercial banking customers with their “too big to fail” security and cutting-edge technology offerings. Outside the industry, a host of start-up and established fintech providers are competing fiercely to capture commercial clients and assets in specific functions like cash management and payments. Meanwhile, another group of nonbanks, large private equity firms, is taking over a growing share of the traditional commercial lending business.

Although regional and smaller banks have proven surprisingly resilient in retaining customer deposits in the wake of the 2023 crisis, eroding confidence among commercial banking clients will leave these banks increasingly vulnerable to these aggressive competitors.

The loss of trust also leaves the U.S. banking industry as a whole more vulnerable to further crisis. The conditions that caused companies to start questioning the stability of their banks in 2022 and ultimately helped bring down SVB and First Republic have not gone away. In fact, concerns about regional and small banks’ high levels of exposure to commercial real estate are raising new worries among commercial banking clients. Decisive action by regulators and the industry helped stave off a run on smaller banks earlier this year. However, diminished trust levels among small businesses and midsize companies could increase the risk of a domino effect if and when the next crisis arrives.

This entry is the first of three blog posts that will examine the competitive dynamics of the U.S. commercial banking industry. In this series, we will pay special attention to the increasing economic pressure on regional and small banks. We begin this analysis with the exploration of client trust levels presented in this post. In our next installment, we’ll look at the new nonbank competitors that are moving aggressively to capture a share of the U.S. commercial banking market, and assess the possible implications for regional and small banks. Finally, in Part Three, we’ll look at what we expect to be one of the main the consequences of the growing pressure on smaller banks: industry consolidation.

The insights presented throughout this series come from the Greenwich Money in Motion platform. Money in Motion equips commercial bankers with unique, high-value client intelligence for the U.S. SME market derived from company-level data on approximately 1.3 million private companies, including wallet estimates, next-best product recommendations, attrition risk identification, wallet share analytics, and quality metrics for more effective prospecting, retention and pre-call planning.

Chris McDonnell, Cheri Derrick, and Kevin Seiler are the authors of this publication.