Are banks struggling to get corporates to adopt their digital solutions? It's no surprise that corporates are at different stages of digital maturity, and some are not willing to try new digital solutions. Banks that deploy a one-size-fits-all approach may find it’s not the best solution for a heterogeneous clientele.

So, how can banks create digital solutions that cater to the unique needs of corporates? Here we explore three questions that can help banks design digital solutions that will benefit from high adoption rates, from quantifying the benefits of self-service capabilities to ensuring ease of implementation and having a solid backup plan.

1. What Does the Client Need?

As an essential principle of entrepreneurship, developing a solution to a problem requires understanding the needs of the client. However, many corporates feel that banks' digital capabilities are challenging to use and require outsourcing technical support to understand the impact to their internal systems/processes and implement the solution.

In addition, the corporate may not fully understand the benefit of adoption, which may trigger reluctance to adopt. While there are a growing number of corporates wanting to be at the forefront of digital transformation, for the majority, “good enough” is still the standard, especially if starved of resources and digital in-house expertise.

As a result, corporates are increasingly seeking tailored solutions and products that respond specifically to their needs. While banks may do this for the largest wallets in the market, the rest of the corporate world does not receive the same level of personalization for their solutions.

To address this issue, banks should adopt a three-step approach:

- Ensure that corporates understand the quantifiable benefits of using the digital solution.

- Incorporate any feedback received from clients and close the feedback loop to keep clients informed about any changes to the solution.

- Develop an agile approach to adding functionalities as they go, but be considerate of the timing of launch.

Reputation and trust are the main drivers of sustainable adoption. If the beta version of the solution is not good enough and clients do not like it, relationship managers and product specialists may face challenges in regaining their trust and convincing them to try again. This effort could be better utilized for other opportunities.

2. How is the Client Supported?

Once a digital solution has been developed, the next step is to support the client in adopting it. Ideally, the solution should be so user-friendly that it does not require any training or implementation. However, in some cases, implementation may be necessary. Banks need to ensure that the process is easy, quick and cost-effective for their clients.

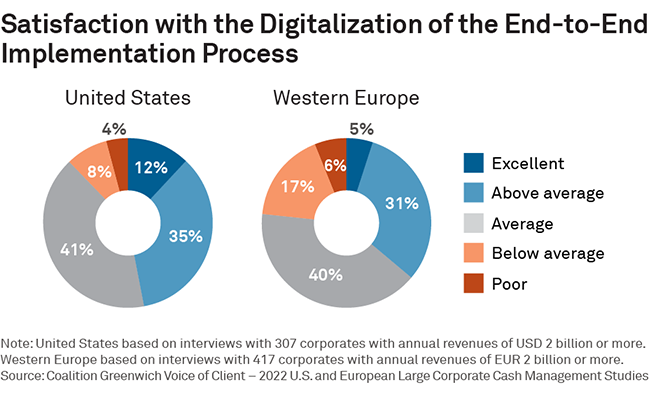

According to our most recent Large Corporate Cash Management Study, global results show a general dissatisfaction with the entire onboarding process. Despite the importance of ease of implementation as a key decision factor when selecting a new banking provider, satisfaction with the digitalization of this process is very low. In Europe, only 36% of corporates are satisfied with this driver, while in the US, the figure is 47%.

It is essential for banks to address this issue and ensure that their corporate clients are able to successfully adopt their digital solutions. Learn more about this topic in our recent report, As Challenges Mount, Corporates Seek Enhanced Support from Their Banks.

3. What is the Back-Up Plan?

In today's digital age, technical difficulties are a common occurrence. From server outages to software bugs, anything can happen at any time. But what happens if your client is in the middle of a digital process when something goes wrong?

This is where having a solid backup plan comes into play. As in most real-life situations, if the client has to essentially change its engine mid-air, it is crucial for banks to ensure that their clients can continue their journey analog and not have to restart from scratch. This is essential to manage execution risk and can save time and frustration for both the client and the bank.

In addition, having a resilient infrastructure is critical for building trust with clients. If outages occur frequently, it can inhibit corporates' willingness to test out new digital solutions.

By understanding their clients' unique needs, quantifying the benefits of self-service capabilities, providing easy implementation and support, and having a solid backup plan, banks can increase adoption rates and reinforce resilience. With the rise of digital transformation and the increasing demand for tailored solutions, banks must stay ahead of the curve and meet their clients' evolving needs.