Table of Contents

2020 has been an incredible year for financial markets and for those that analyze them. The year has been littered with spectacular events, many of which were completely unprecedented. Some events reversed long-standing trends, while others accelerated them. Analyzing all these events and deriving useful strategies for the future has been a real challenge. This is true in many markets, but in the U.S. Treasury market, more so than most. For each explanation analysts put forward, there seem to be new questions raised.

The past year has illuminated many challenges in the U.S. Treasury market. At the very beginning of the crisis, Treasuries performed their normal function as a “flight to safety,” as risk markets sold off in a big way once the danger of COVID-19 became apparent. Then, as both firms and individuals began to hoard cash and draw down their credit lines in anticipation of lockdowns of indeterminate lengths, the Treasury repo markets, where money center banks fund, tightened extremely. Many financial market arbitrageurs also fund in these markets, and the tightness may have helped to weaken the link between cash and futures markets. The Federal Reserve was quick to intervene in this market at scale, but its effects have lingered.

UST Market—From Safe to Uncertain

Then sovereign governments, facing the same pressures as individuals and firms, began to sell off their U.S. Treasury holdings, causing them to sell off rather than rally in a crisis. This caught a great many people off guard and upended many strategies that rely on Treasuries as a hedge. A massive wave of issuance followed in order to fund stimulus and COVID relief packages, while the Federal Reserve revived quantitative easing and committed to keep rates lower for longer—much longer.

Finally, as the end of the year approached, the U.S. election caused a stir and the announcement of a vaccine has created uncertainty about the longevity of the Fed policy, the potential for renewed inflation, and whether the monetary and fiscal authorities will properly steer us out of the crisis to a return to normalcy.

All of these events, whether unprecedented or extensions of larger trends, provoked soul-searching across Wall Street. One academic has asked whether the events of Q1, when combined with continued record issuance and Basel III-constrained balance sheets, might mean that the primary dealer system is simply not large enough to cope with the challenges of the U.S. Treasury market on its own. He speculates that mandatory central clearing could be the answer.

The Fed itself put out a fascinating study on the relative market impact of different market participants. They did this using order book data combined with TRACE data that only they possess. The paper showed that different market participants indeed differentially move the market, and inadvertently demonstrated that additional transparency for market participants may be helpful.

Given the great diversity of events that have shaken the U.S. Treasury market and the wide variety of the analyses that are being applied to them, what can market participants take away from 2020? With regard to the trajectory of monetary policy, issuance under the new administration, and likely events in the market structure, it is extremely difficult to determine what’s ahead.

Perhaps the main lesson of 2020 is that, not only is it difficult to see the future, it’s extremely difficult to accurately perceive the present or even to interpret the past. This surrender to the whims of fate may seem like a justification for inaction. On the contrary, it suggests a very specific course of action. This is because U.S. Treasury markets have a tool with which market participants can manage this uncertainty—options on Treasury futures.

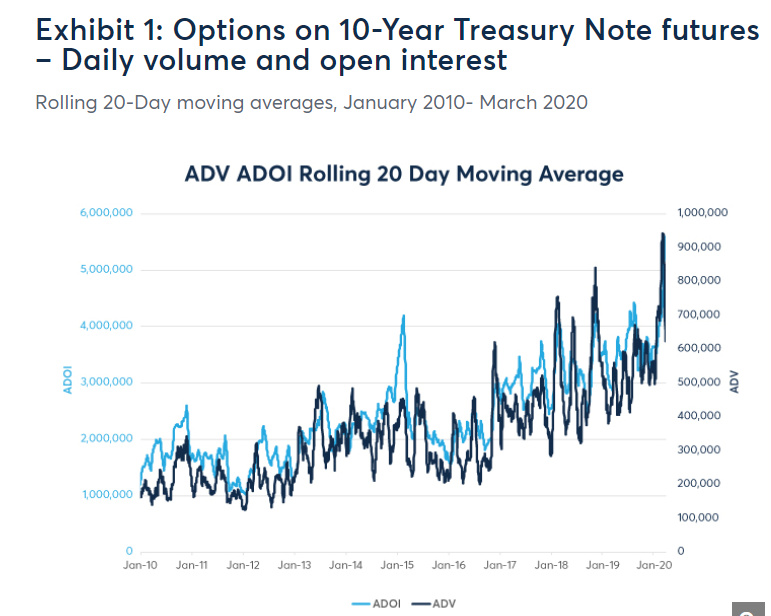

Source: CME Group

Source: CME Group

Keeping Your Options Open

Options significantly enhance a market participant’s capacity to deal with uncertainty. They enable the user to take asymmetric and time-limited positions, thus allowing investors to build conditionality into their outlook. Additionally, individual options can be used as building blocks, combining into spreads and other combinations to allow an investor to construct a single strategy that incorporates both long and short positions, conditional on different underlying prices through different time periods. The flexibility is nearly infinite.

While much has been said about the growth of equity options with stories of the Nasdaq whale and Robinhood traders taking equity option volumes to new records, equities are not the only asset class where options can be useful, and are certainly not the only place where they are growing. As mentioned, it has been a very unusual year in the Treasury market, with many unprecedented events and surprises.

This is the perfect environment for options trading. 2020 follows a period in which investors were increasingly using options to manage the risks in the Treasury market. Options on Treasury futures volumes have been outpacing cash futures volume growth in recent years. From 2014–2019, Treasury options volume grew 83% relative to a 54% increase in futures volumes.

Source: ICE BofA MOVE Index via the Greenwich MarketView application

Source: ICE BofA MOVE Index via the Greenwich MarketView application

It should be noted that while volatility is a key component in options pricing, options are useful in both high- and low-volatility environments. For example, in 2020, U.S. Treasury volatility has itself been volatile. The above is a look at the ICE BofA MOVE Index via the Greenwich MarketView application. It clearly shows the massive spike in volatility during the COVID crisis and the positioning in front of the U.S. election. It is interesting to note that even though there was heightened activity in Treasury futures options around the time of the U.S. election, the overall level of volatility was still relatively low compared with the pre-COVID era.

Navigating Options Markets

If options are great tools for navigating the uncertainties of the Treasury market, what tools are there for navigating the options markets? This is an important question to answer because, relative to futures, the utility of options is not always equally matched by their liquidity. It can be significantly more difficult to work an options order than a futures order. The sizes tend to be smaller and the bid-ask spreads wider, making it harder to shape up the market pre-trade or to estimate transaction costs in advance.

In the futures markets, investors typically might use algos to work their orders over time to minimize market impact and transaction costs. Precisely for the reasons outlined above, this can be complicated in Treasury options. Algos require high-quality quote and transaction data in order to work optimally.

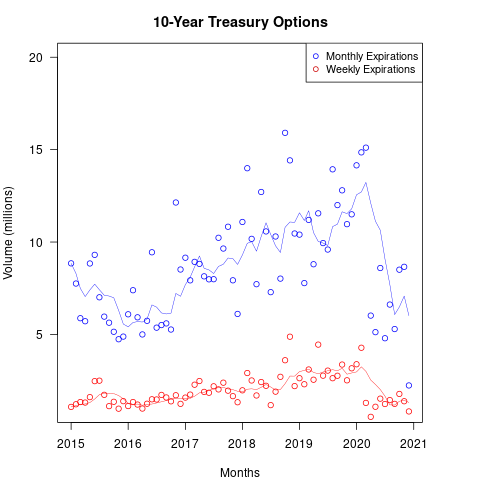

Though the utility of options increases in conditions like those of 2020, according to the chart below by Quantitative Brokers (QB), overall volumes have declined precisely because they are difficult to trade. For one thing those volumes are spread across many more instruments (because there are so many strikes) than futures volumes, and quote quality is not ideal. Thus, it has been very difficult to create algos for options markets that are as effective as those in futures markets.

Source: Quantitative Brokers (QB)

Source: Quantitative Brokers (QB)

This may be about to change. An algo developer has found a way to fill in some of the blanks in the U.S. Treasury options markets. QB, a firm with long experience in Treasury markets, has levered a concept called “implied quotes” that the CME itself uses in some of its order books to enhance its spread functionality. What QB has done is utilized a specific aspect of the CME options order book in order to generate additional intelligence about the pre-trade conditions in the market.

As mentioned, spreads are combinations of options that can be built to create very specific strategies individually tailored to the needs of a given investor. Some spreads are commonly used, so the CME has created an order book in which users can create their own spreads and ask the market to quote them as a separate instrument.

Because some spreads are traded more often than individual options or have more attractive risk characteristics, they can more aggressively quote than the options that comprise them. More to the point, the spreads can be decomposed into those individual options, and quotes for the individual components can be implied from the quotes of the spread.

The Outlook for Algos

This has extraordinary power for advancing algo development and trade execution. An algo that is levering the spread order book is significantly improving its access to data about the current willingness of the market to trade. It can use this to more strategically place orders in the central limit order book, increasing their likelihood of execution against orders in the spread order book or eliciting unposted trading interest to fill posted orders. Being able to place orders with a better sense of the true market than can be gleaned from direct observation is a major advance.

Still, it is early days for Treasury options trading algos and, if 2020 has taught us anything, it’s that the future is uncertain. That said, it has also shown us that many of the extraordinary events of the past year have served as accelerants to existing trends, and that market participants are eager to innovate.

It has also shown that the Treasury market, despite the guidance given by monetary authorities, remains a very uncertain place, and that options play an increasingly vital role in managing the risks of the world’s risk-free asset. It seems a fairly safe bet that algos that can see more deeply into these markets will be just as useful to options users as the options themselves.