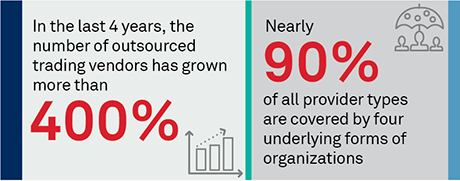

In a market with rising volumes and volatility, yet continuing commission compression and challenging regulatory scrutiny over every aspect of the trade life cycle, more and more firms have begun to explore the opportunities afforded by outsourced trading providers. However, not all outsourced trading firms are cut from the same cloth. Institutions need to recognize the various attributes of the firms that offer these services and the important issues driving the ultimate goal for any firm—achieving best execution for its clients.

Outsourced trading providers offer several different models—ranging from those housed within larger financial institutions to those that are primarily dedicated to offering only outsourced trading. Whatever the model, even the firms that have grown accustomed to these providers still need to probe into the intricacies of how they meet their clients’ needs. Whether it is as a full-blown outsourced trading service or a supplemental trading offering, the scale, scope and expertise of the firm providing the offering must all be scrutinized. Depending on the services required, local presence in disparate geographic centers may also be important. Of course, the importance of operational fundamentals cannot be overlooked. At the end of the day, the outsourced provider must be able to offer an additional avenue to enable the institution to achieve its best-execution obligations.

In this paper, we examine the rise of outsourced trading firms, the evolution of the offering (including the expansion into supplemental trading), the types of firms offering outsourced trading, and the factors driving success (or failure) of an outsourced trading relationship.

MethodologyIn the first half of 2022, Coalition Greenwich spoke with U.S.-based financial services professionals familiar with the outsourced trading business to gain insights into its functioning, prospects for growth and competitive landscape. This study is also based on independent research on the subject conducted by Coalition Greenwich.