Commission Rates Are Only Part of Story in Managing Spend

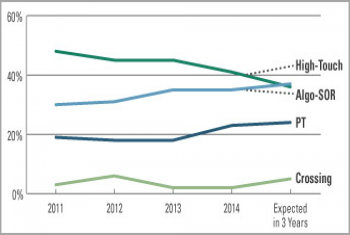

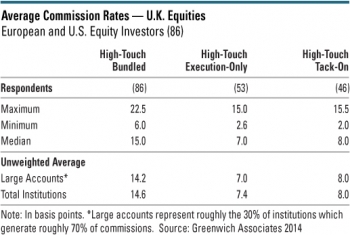

Our recent report, “Equity Trade Commissions: Rates Vary Broadly Across and Within Markets,” highlighted an interesting finding from a Greenwich Associates study: average bundled commission rates on equity trades are surprisingly consistent across...