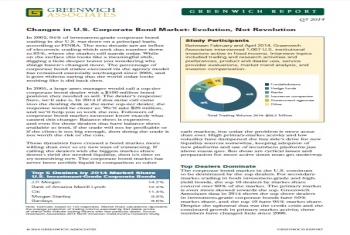

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint.

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint.

The penetration of electronic trading across the financial markets is remarkably inconsistent. While equities and foreign exchange are largely traded over platforms, the same cannot be said for much of the fixed income market.

Another year down. We're a year further from the Lehman bankruptcy, a year further from the signing of Dodd-Frank and a year closer to the full implementation of Basel III.

Early in November I chaired the FTF DerivOps conference in NY. The conversation in 2014 was a lot more about the market than it was at my first DerivOps in October 2008, when all we spoke about was what was wrong with the OTC derivatives market and...

I’m not a great fan of regulation for regulation’s sake. While this is too strong and cursory a judgment on what has been happening in the US and Europe for the past few years, some suggested regulatory changes make you wonder. For instance, recent...

High costs can be a barrier to success for any swap execution facility (SEF), but there’s more to it than that. Based on our conversations with the buy side, simple fee models are preferable. Thankfully most major SEFs have taken a transparent...

A reduction in systemic risk is one great benefit of global financial reform; another is the increasing volume of data made available to market participants and observers.

Market structure changes in the bond market appear to be happening organically. Shocking I know. Rewind back seven years to 2007. Market structure research was primarily focused on technology innovation, evolving business models and a steady move...

I'm of the belief that the regulatory changes with the biggest long term impact are those related to the cost of capital. Basel III, CRD IV and whatever the US regulators ultimately decide will prove to be both the carrot and the stick for OTC...

I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some headway in...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder