The COVID-19 crisis further cemented the importance of relationships, even in the highly electronic FX, and beckoned some noteworthy behavior shifts that are likely to persist in the coming years.

The COVID-19 crisis further cemented the importance of relationships, even in the highly electronic FX, and beckoned some noteworthy behavior shifts that are likely to persist in the coming years.

Record low interest rates and a pandemic that shut down the global economy have pushed the wholesale banking industry into innovation overdrive. At the current pace of change, the operating model for corporate and transaction banking is likely to be...

One might suspect that an ecosystem as active as the one for loans would have brought with it electronification over the past decade, similar to the e-trading growth seen in corporate and government bonds.

Market structure trends are making the economics of executing FICC product trades on multidealer platforms increasingly expensive, prompting buy-side and sell-side firms to explore new ways of interacting directly.

Despite skepticism around the efficacy of trading away from the bustle and rigorous infrastructure of the trading floor, the shift to trading from home went off mostly without a hitch. Here we take a look at the budgets and tools on buy-side trading...

1Q21 recorded the highest first quarter investment banking revenues in the past six years driven by strong growth across products.

For investment managers, data and research products can be thought of as raw materials—the input that is taken in, processed into investment ideas, fused into portfolio construction, and used to create investment portfolios.

While the global financial crisis is now over a decade in the past, the changes it brought to the swaps market are still strongly evident today.

Coalition Greenwich research with investment consultants and institutional investors has shown that there is a measurable link between how consultants and investors perceive an asset manager’s commitment to diversity and inclusion and their level of...

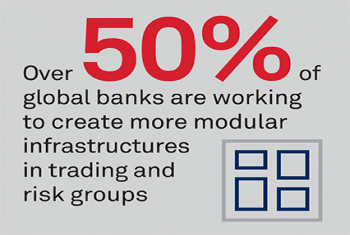

Business priorities ultimately shape technology decisions, not vice versa. But bank priorities are strongly affected by the regulatory landscape, as well as concurrent technology advances that make new technology decisions possible. This is...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder