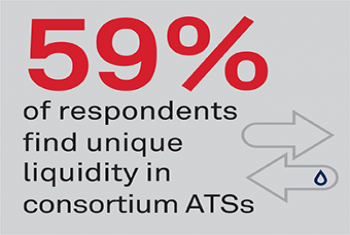

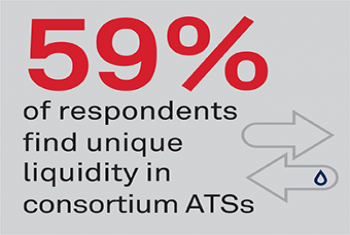

For volume executed away from the exchanges, in particular on the alternative trading systems (ATSs), one familiar question is whether liquidity or uniqueness is more important for a venue.

For volume executed away from the exchanges, in particular on the alternative trading systems (ATSs), one familiar question is whether liquidity or uniqueness is more important for a venue.

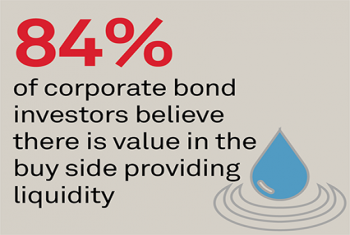

The incredible evolution of the corporate bond market over the past decade was moving forward at a swift pace as 2020 began. In March, the COVID-induced market panic began bringing with it (among other things) a huge test of corporate bond market...

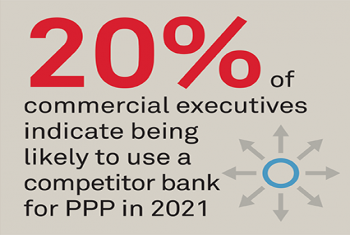

Record numbers of small businesses and midsize companies in the U.S. are considering switching banks due to what they saw as inconsistent support from their banks during the COVID-19 crisis. As commercial banks compete for this “money in motion,”...

Over half the 101 global institutional investors participating in a new joint PGIM-Greenwich Associates study say climate change is already affecting their portfolios by creating new risks and generating new opportunities.

The last year has brought technological disruption to capital markets that, in normal times, would have taken five years or more to play out.

The lines between the portfolio management system (PMS) and the order management system (OMS) are getting blurrier by the day.

Consumer lending markets have operated with little major change for over a century. Loan sizes have grown and regulations have become more onerous, but until about 15 years ago, the market remained remarkably similar to the one portrayed in the...

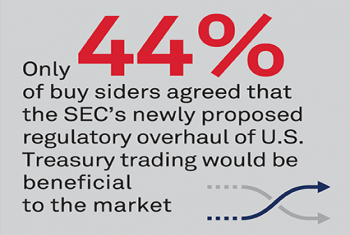

The systemic importance of the U.S. Treasury market cannot be understated. 2021 will see strong issuance of new bonds, and secondary market volatility, as the market and the world digest the monetary and fiscal policy responses that come with it.

Asset managers are discovering a new tool in the fight for increased profitability in an increasingly competitive institutional market: persona client segmentation.

Increased adoption of surveillance and monitoring technology on the buy side has accompanied a rise in third-party solutions tailored to the buy side’s unique scalability and functionality—and not at all coincidentally.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder