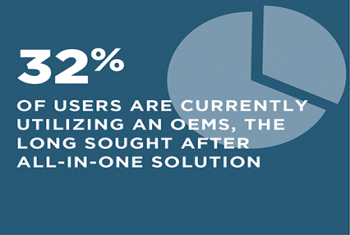

This new Greenwich Report examines the changing size of the alternative data market, identifies the leading companies in the space and examines the evaluation process for these data sets..

This new Greenwich Report examines the changing size of the alternative data market, identifies the leading companies in the space and examines the evaluation process for these data sets..

Electronic trading is growing marketwide, although top-line growth in the past two years has slowed from revolutionary to evolutionary.

Recognizing that marketing activities are going to shape the future of the firm and the industry as a whole is an important milestone for any organization striving to survive and thrive in the years ahead.

In complex markets with strict best execution rules, the emerging practice of “venue analysis” emerges as a key tool for U.S. investors.

Greenwich Associates has mapped and sized the world of institutional fintech, outlining the major areas of development across the entire investment lifecycle.

An array of factors, including an information explosion, new regulations, new technologies, and evolving commercial models, are coalescing to bring about significant change in the investment research landscape.

The electronification of foreign exchange trading has entered a new phase.

Technology spending by asset managers, hedge funds and other buy-side firms is quickly catching up to compensation expenses.

We explore the current state of blockchain adoption, continued investments by market participants and key challenges and expectations for the future.

The wait is almost over. Since their introduction in 2013, Dodd-Frank-inspired swap execution facilities (SEF) rules have been widely perceived as overly prescriptive.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder