Table of Contents

In the face of the global pandemic, institutions across Europe sought to minimize portfolio risk levels last year by directing assets into familiar European fixed income and equities. That strategy represented a reversal of recent trends, in which institutions had been increasing allocations to specialty and international strategies in an effort to generate yield amid the now decade-long environment of low interest rates. As a representative from a public pension fund in Norway explains, “The extreme market volatility seen in March 2020 added another concern to the already low interest rate level and liabilities.”

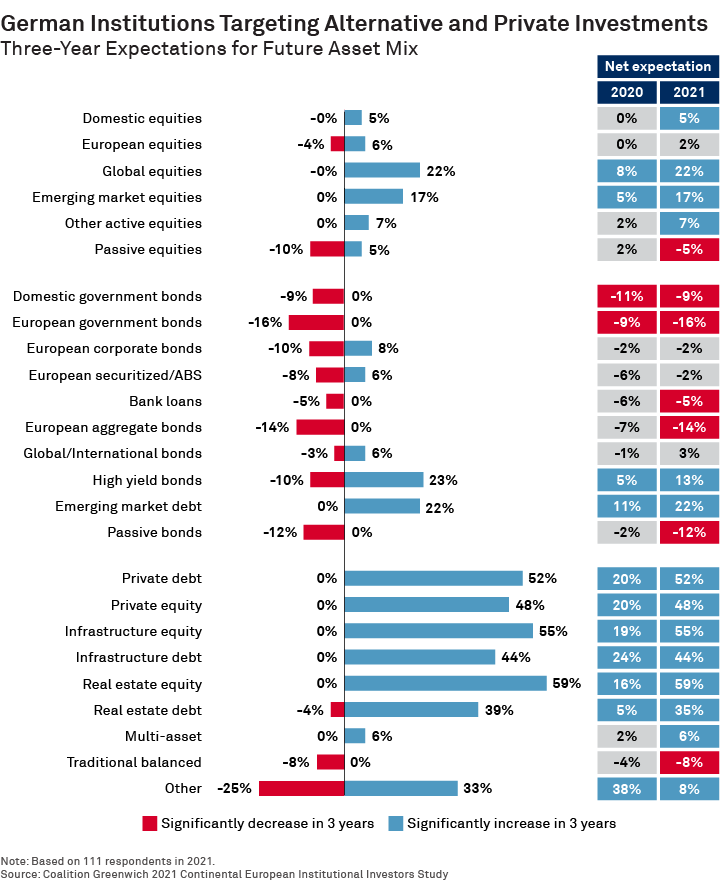

By all accounts, this reversal seems to be temporary. As shown in the chart below, European institutions have every intention to quickly return to their long-term strategy of increasing exposure to risk assets. That includes global and emerging market equities, emerging market debt and a host of alternative and private asset classes, such as private debt and equity, infrastructure and real estate. As a study participant from a German public pension fund explains, “We are incrementally taking more risks by shifting to more credit risk, real estate and illiquid assets like private debt, at the expense of low-yield assets like government bonds, and shifting from passive equities to active managed equities.”

ESG: A Mainstream Driver of Manager Selection

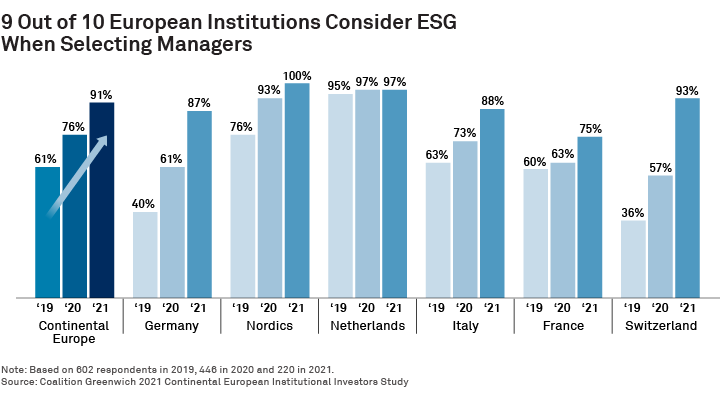

The surge in demand for environmental, social and governance (ESG) assets will prove a more lasting trend. As recently as 2019, many institutional investors were taking a go-slow approach when it came to ESG. But new sustainability regulations are accelerating changes across the ESG landscape. Throughout Europe, the share of institutions including ESG criteria in manager selections jumped to 91% in 2021 from just 61% in 2019, with institutions in the Nordics and the Netherlands leading the charge. “Responsible investments and ESG issues will be the future driver for our investment policy,” says a study participant from a corporate pension fund in Finland.

Germany and Switzerland, which have trailed their counterparts in other countries in this area, experienced a massive uptake of ESG last year. As shown in the chart above, the share of German institutions considering ESG in manager selections surged to 87% in 2021 from 61% in 2020. The increase was even more dramatic in Switzerland, where ESG usage jumped to 93% from 57% over the 12-month period.

Across Europe, nearly two-thirds of institutions now rank ESG criteria among the most important factors driving manager selection. That share tops out at 85% in the Nordics. Even in countries much slower to embrace sustainability, more than 40% of institutions now include ESG in their list of most-important considerations when selecting an asset manager.

![]()

Surge in Manager Hiring

This rapid adoption of ESG criteria will have a significant impact on the European asset management industry because it is occurring in the midst of a dramatic pickup in institutional hiring activity. The share of European institutions planning to hire a new manager in the coming 12 months increased to 30% in 2020 from just 21% in 2019. In traditional asset classes, institutions are issuing the most mandates in global equity, emerging markets equity, European equity, and global and European investment-grade credit. However, demand will be strongest in alternative asset classes, especially infrastructure debt and direct private equity.

2021 Greenwich Quality Leader: Continental Europe

Allianz Global Investors, the 2021 Greenwich Quality Leader in Overall Continental European Institutional Investment Management, distinguished itself from competitors last year by actually improving its service quality ratings during the global pandemic and market crisis. “The combination of strength in multiple asset classes and market-leading client service made AllianzGI the clear quality leader in continental Europe,” says Coalition Greenwich consultant Mark Buckley.

Germany

As markets normalized after COVID-19 disruptions in 2020, German institutions returned to their long-term plans to increase exposure to less-liquid and higher-risk products that can help generate badly needed yields in an era of negative interest rates. The chart below shows the large number of institutions planning to significantly expand allocations to a broad range of alternative and private asset classes, largely at the expense of government bonds. “Due to the sheer size of institutions’ fixed-income holdings, even small reductions in allocations can free up enough assets to constitute significant exposures to illiquid asset classes,” says Mark Buckley.

In step with these plans, German institutions plan to pick up the pace of manager hiring. Fully a quarter of institutions participating in this year’s study said they planned to hire a new manager in the next 12 months, up from just 14% in 2020.

German Institutions Jump on the ESG Bandwagon

German institutions have been slower than their counterparts in other European countries to integrate ESG criteria into their investment processes and portfolios. However, driven in part by new regulations governing sustainability, adoption rates among German institutions surged last year to levels much more in line with those of their European peers.

As recently as 2019, only 40% of German institutions considered ESG factors when selecting asset managers. That share climbed to 61% in 2020, and has jumped again to 87%. Among German foundations and churches, three-quarters of study participants now rank ESG criteria among the most important factors in manager selection—as do 70% of German corporate pension funds.

2021 Greenwich Quality Leaders: Germany

The 2021 Greenwich Quality Leaders in Overall German Institutional Investment Management are Allianz Global Investors, PIMCO and Union Investment. All three of these firms set themselves apart in a year of crisis with both highly ranked investments and superior service quality ratings. “Our Quality Leaders focused on making sure they were doing everything they could do to take care of clients during a challenging year,” says Mark Buckley.

Consultants Mark Buckley and Sophie Emler advise on the investment management market in continental Europe.

MethodologyFrom January to May 2021, Coalition Greenwich conducted in-depth interviews with 518 key decision-makers at the largest continental European institutional investors. Institutions included continental European corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks (including Sparkassen in Germany), foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.