Spot FX trading volumes in the first quarter of 2014 dropped 25-30% from the same period last year. From a macro-economic perspective, the reasons are relatively clear.

In 2013, FX trading volumes were inflated by a surge of activity in the first quarter brought on by uncertainty surrounding ongoing concerns about the Euro-zone crisis and the debt-ceiling stand-off in Washington DC. The market lost that momentum as those crises subsided, and 2014 has to date lacked similar market-moving events. The crisis in the Ukraine and continued concerns about slowing economic growth in the emerging markets are certainly important to watch—but neither has sparked the levels of volatility required to trigger a surge of FX trading activity comparable to 2013.

Two of the historically biggest sources of FX trading volume—hedge funds and central banks—have also slowed their trading activity in 2014. Hedge funds in Q1 2014 delivered their worst aggregate quarterly performance since the onset of the global crisis and have trailed the S&P in performance for the past 12 months. This weak performance has reduced hedge funds’ appetite for FX risk and dampened their trading activity.

Many central banks, particularly in Asia, have slowed or halted their “diversification” of assets out of USD, diminishing what had been a steady driver of FX trading volumes. Interventions by the Bank of Japan, which last year triggered waves of trading activity as they weakened the yen, are also having less of an impact this year.

More than a Cyclical Change?

While this combination of market forces has clearly dampened FX volumes, they are not FX specific. A similar drop in fixed income volumes and revenues suggest these factors are at play across the capital markets. That said, Greenwich Associates believes there are other FX specific factors at play that could signal this FX volume slump to be more than just a cyclical downturn.

Sell side trading resources have thinned out considerably over the past months. An investigation into improprieties in the setting of FX benchmarks has resulted in the suspension of a sizable number of sell-side traders. Additionally, front-office resources, including heads of sales, are spending a disproportionate amount of time on regulatory issues such as compliance and meeting with policy makers. This is all time and resources that used to be focused on generating more trading volumes, and hence revenues, from clients.

To further complicate things, in what amounts to a wholesale re-thinking of longstanding FX sales and trading market practice, sales people and traders are becoming less comfortable sharing with clients trade ideas and market color based on their view of the activities of other clients and the market as a whole. With regulators particularly sensitive to any activity that even appears improper, trading desk employees do not want to create any perception that client confidences are being breached. This new reticence is weakening what has traditionally been a strong driver of direct voice trades to top brokers.

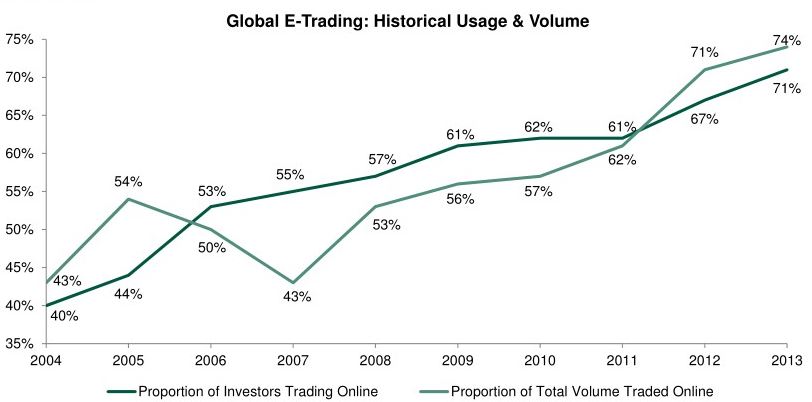

Greenwich Associates estimates that top FX dealers manage about 80% of their risk with internal algorithms (which closely mirrors client electronic trading percentages). With the vast majority of risk hedged electronically, sell-side traders are unlikely to be able to influence the direction of the market materially. And with sell-side proprietary trading desks mostly defunct due to the Volcker Rule, big bank control over FX market volumes and direction is undergoing change beyond cyclical norms.

To that end, these changes and the current slowdown in trading activity are raising the question of whether the spot FX market might be in the midst of a more secular shift. With resources tight and capital even tighter, a major change in the FX business model could very well be in the works. An equities-like environment in which most trades are done on an agency basis and executed via exchange is now within the realm of possibility. If trading evolves along those lines—and if, as part of that process, clients become more circumspect about trading with the leading FX dealers—the market’s competitive landscape could change meaningfully. That is not to say the top tier won’t remain the top tier, but it does open the door for new entrants to provide liquidity and services where the big dealers no longer can do so profitably.

Dealers that have focused on their electronic strategies as their willingness to commit capital has declined would also be beneficiaries of such a change. Greenwich Associates is advising its sell-side clients to invest in their electronic platforms in order to take advantage of a potential shift to agency-style trading. Even still, trading ideas presented to clients will continue to generate profits and dealers are strongly advised to maintain a solid flow of intellectual content as such. Low touch does not mean no touch. And lastly, providing clients with access to FX derivatives will also remain a strong profit generator, despite the impact regulations are set to have on product selection. Helping clients execute these trades efficiently through a deep understand of the market structure and changing cost structure will also prove a competitive advantage over time.