While the global financial crisis is now over a decade in the past, the changes it brought to the swaps market are still strongly evident today.

Press Releases

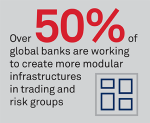

Regulatory Compliance and Efficiency Enhancements Drive Aggressive Bank Technology Agenda in Trading and Risk Function

May 11, 2021

Although COVID-19 disruptions have temporarily depressed demand for new banking products and business lines, banks are setting an ambitious technology agenda.

Asset managers that commit to diversity and inclusion are more likely to be recommended by investment consultants and considered for mandates by institutional investors.

Coalition Greenwich, the leading global provider of data, analytics and insights to the financial services industry, is pleased to announce the hiring of Stephen Bruel as a Senior Analyst on its Market Structure & Technology team.

The growth of algorithmic trading and its implications for U.S. equity markets are topics of frequent media discussion but what receives considerably less attention is exactly which algorithmic strategies investors are using.

U.S. investment consultants have spent more than a decade expanding their relationships with institutional clients beyond their traditional realm of manager searches and into deeper strategic partnerships with investors.

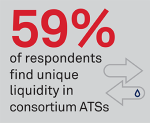

All-To-All Corporate Bond Trading Goes Mainstream

April 20, 2021

Long held assumptions about how corporate bond markets operate have changed as investors and dealers are increasingly comfortable trading anonymously with best execution the ultimately goal.

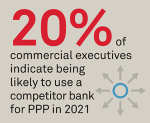

Record numbers of small businesses and midsize companies in the U.S. are considering switching banks due to what they saw as inconsistent support from their banks during the COVID-19 crisis.

Half of financial market professionals participating in a new study from Greenwich Associates think the challenges of working from home in 2020 actually made markets more efficient by accelerating the uptake of digital communication and collaboration tools.

Buy-side trading desks are getting closer to realizing their vision of end-to-end integrated order management and portfolio management systems—thanks in large part to the cloud.

Pages

Media Contacts

Media Inquiry

Awards

- 2023 Greenwich Leaders: Asian Large Corporate Trade Finance

- Indian Corporates Turn to Big Banks to Fund Ambitious Growth

- Investment Consultants Support U.S. Asset Owners in Volatile Markets

- 2022 Greenwich Leaders: U.S. Institutional Investment Management

- 2022 Greenwich Leaders: U.K. Institutional Investment Management