New Greenwich Associates Report Examines Ways to Enhance Bond Market Liquidity and Transparency

June 3, 2020

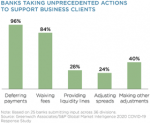

The unprecedented volatility triggered by the COVID-19 crisis demonstrates the importance of preserving and even expanding liquidity in corporate bond trading.