We conducted over 200 interviews with institutional investors around the world and found that more buy side FX traders use derivatives than those focused on other asset classes.

Last week I attended the sold-out Empire Startups FinTech conference in NYC. From the moment I walked in I realized this was not your typical stop on the conference circuit...

Implementing a pilot that will narrowly look at just one part of our controversial market structure will not result in any meaningful improvement.

The buy side's ability to make a price in the market does not make them market makers.

Three interesting developments as blockchain experiments expand into more asset classes.

I recently participated in a great panel discussion with James Jockle from Numerix and Kazu Yokokawa from the Nomura Research Institute. I look forward to getting an update from Kazu on the POCs they are working on!

Richard Johnson, Greenwich Associates vice president of market structure and technology, discusses the results of the firm's survey of 256 buy-side traders around the world. He speaks with Bloomberg's Alix Steel on "Bloomberg Markets."...

The governance of an arcane construct of US Market Structure - NMS Plans - can have a profound effect on how our markets work.

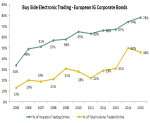

Europe has long led the charge in fixed income e-trading adoption. But our latest study of corporate bond investors in Europe points to a potential glass ceiling.

Kevin McPartland's discussion with Bloomberg TV about why the Fed shouldn't hyper focus on short term market volatility, how bond market liquidity has changed but a crisis isn't likely, and last but not least how relationships still matter even...