The exchange-operated opening and closing auctions or “crosses” are becoming an increasingly important part of the trading day...

The exchange-operated opening and closing auctions or “crosses” are becoming an increasingly important part of the trading day...

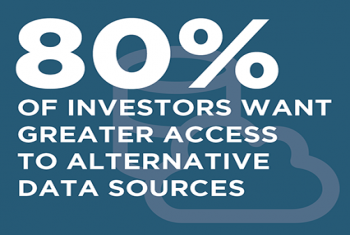

The buy side today has access to data and information that would have been unheard of 20 years ago. Whereas in the past they relied primarily on research and information from their sell-side trading counterparties, today they have as much, if not...

Even organizations that spend significant resources on customer experience management (CEM) programs often focus their efforts exclusively on front-line staff and procedures while excluding back-office and other non-customer-facing functions.

Find out how the changing role of buy-side traders will impact how they evaluate, select and reallocate commissions to brokers.

Investors continue to express frustration with credit market liquidity, but massive efforts undertaken by market participants and service providers are finally starting to ease the pain.

2016 will go down as the Year of the Unexpected, as Brexit, Trump and the Chicago Cubs upended “likely outcomes.”

Pay levels in the asset management industry are on the decline in 2016—marking the second consecutive year of reduced compensation for professionals at traditional asset management firms and the third for hedge funds.

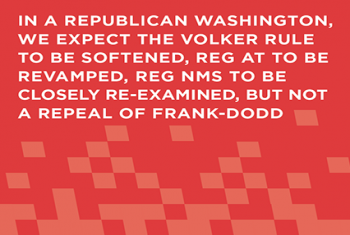

Just as the U.S. swaps market was starting to feel some market structure certainty, the political situation in Washington was upended, bringing uncertainty back.

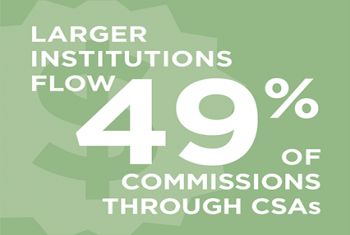

Though MiFID II implementation is still well over a year away, larger global and European asset managers are already taking actions to address its core requirement to separate payment for research from execution.

Eight characteristics that define Best-of-Breed Platforms of digital banking; Priorities for today and tomorrow

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder