With the advent of progressively more rigorous capital requirements, dealers have been compelled to reprice interest-rate derivative products.

With the advent of progressively more rigorous capital requirements, dealers have been compelled to reprice interest-rate derivative products.

The fixing scandal of 2013/2014 sent shockwaves through the global foreign exchange markets. As traders and investors discovered that key benchmark rates had been manipulated by large dealers, they have shifted towards utilizing algorithmic trading...

In the age of algorithmic trading with execution speeds measured in microseconds, the race to reduce market data latency has captured the attention of market data professionals and quantitative traders for the better part of a decade.

Industry stakeholders around the world (including dealers, institutional investors and regulators) are seeking to enhance standards of conduct across the financial services industry.

Banks today feel like analog players in an increasingly digital world. Yet change is coming fast: Within the next decade, they will feel and operate more like tech companies with banking licenses. Buyers of wholesale banking services have started...

Greenwich Associates spoke to corporate treasury professionals in Europe and the U.K. to learn how businesses are dealing with the uncertainty, how prepared they are for a Brexit and how they feel it would impact their investment strategies and bank...

The electronic trading revolution hit the foreign-exchange market years ago, but the macroeconomic and regulatory-driven events of the past few years are spurring a new wave of change.

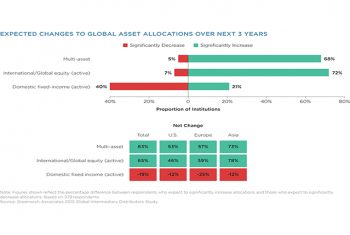

For asset managers selling their products on intermediary platforms, the landscape is changing quickly.

Heightened regulatory pressures coupled with years of perennially low interest rates continue to stress banks’ trading businesses, with fixed-income revenues garnering a smaller share of the overall top and bottom lines for most traditional dealers...

According to the latest Greenwich Associates research, over 70% of buy-side equity traders use third-party EMSs. Brokers often label this breed of trader as “active.”

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder