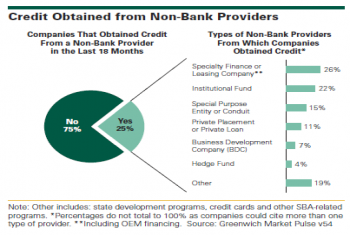

A notable share of U.S. small businesses and middle market companies are obtaining credit from non-bank providers.

A notable share of U.S. small businesses and middle market companies are obtaining credit from non-bank providers.

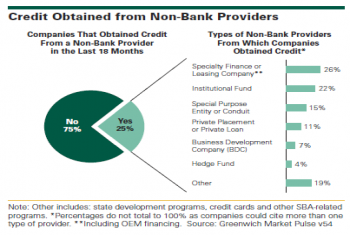

Corporate users continue to concentrate their IRD business among their top three dealers, while asset managers and hedge funds are starting to diversify their lists.

Investors’ desire for low-touch trading is tempered by content needs accessible only through high-touch channels.

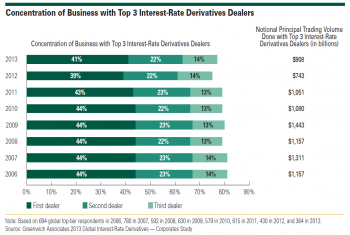

Despite lower market volumes, U.S. equity investors seeking content drive up the commission wallet.

Mid-tier brokers see strong gains as research source, now accounting for 40% of the research wallet.

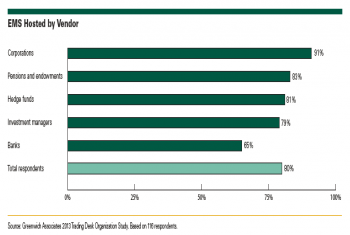

Hedge funds could see IT costs slashed by using cloud computing on demand.

Buy-side equity traders favor electronic trading for cost, but commission dollar requirements and other issues often curtail use.

Greenwich Associates research finds top foreign exchange dealers can expect increasing market share concentration, while top fixed-income dealers should see more fragmention.

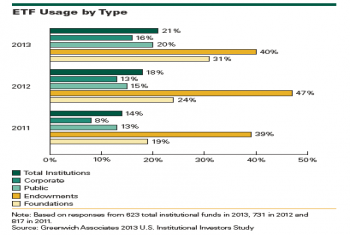

ETF usage is climbing as institutional investors adopt for routine portfolio functions and as a means of obtaining long-term strategic investment exposures.

Greenwich Associates used top-line findings from its unique Online Services Benchmarking research to present companies with a detailed and updated guide to the capabilities now available from online corporate banking platforms.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder