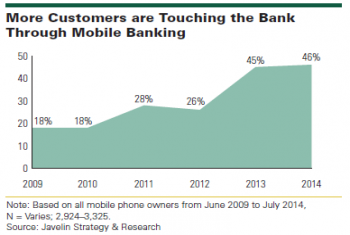

The walls separating traditional bank channels from the digital world are breaking down fast, and banks' customer experience efforts must keep pace.

The walls separating traditional bank channels from the digital world are breaking down fast, and banks' customer experience efforts must keep pace.

With an impressive 79% of institutional investors using social media at work, Greenwich Associates research shows that social media is offically part of the financial services mainstream.

With bonds expensive and providing little income potential, investors are looking for more attractive opportunities...

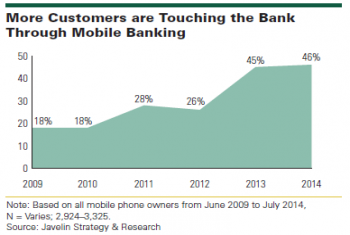

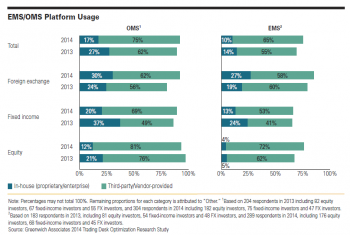

75% of institutions’ OMS platform usage is now with outsourced solutions, while 84% use third-party providers for EMS platforms.

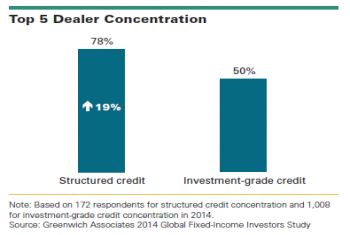

The other major trend coming out of this technology rationalization is the push to form new market utilities and expand the use of existing platforms.

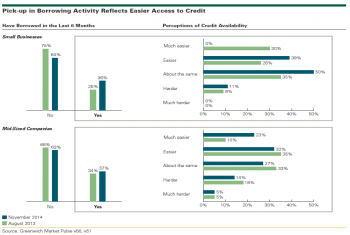

Bank satisfaction levels remain so high among small businesses and mid-sized companies despite widespread fears that new regulatory compliance demands would have a negative impact on clients and damage customer satisfaction levels.

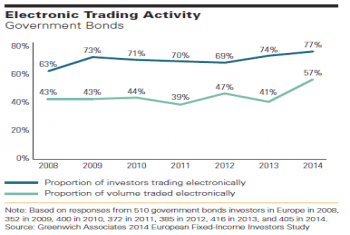

In European FI, the ongoing trend toward electronic markets mirrors a broader leadership in digital communication that outpaces the U.S. market.

While many financial models are a key driver of profits on both the buy side and sell side, the oversight of those models and their use is a common complexity faced on the Street.

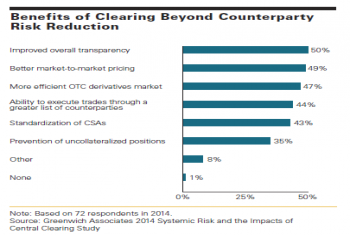

Central clearing of derivatives is leading the charge toward systemic risk reduction.

Over the medium and long term, futures products will gain traction at the expense of more standardized cleared swaps.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder