Institutions Seek Asset Managers Providing Superior Service and “Solutions”

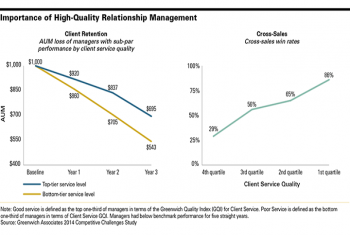

In volatile markets, client service can be the make-or-break factor for investment management firms when it comes to winning—or losing—customers and assets.

In volatile markets, client service can be the make-or-break factor for investment management firms when it comes to winning—or losing—customers and assets.

U.K.-based partnership Baillie Gifford and U.S. liability-driven investment (LDI) specialist NISA Investment Advisors are the Greenwich Associates 2015 Quality Leaders in U.S. Institutional Investment Management Service.

Total notional volumes for retail structured products distributed by U.S. firms remain at over $54 billion annually.

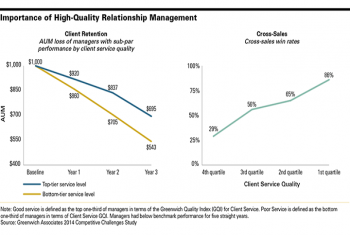

A dearth of client trading activity in Japanese government bonds has triggered a push by the country’s largest domestic fixed-income dealers into non-yen products, particularly non-yen government bonds.

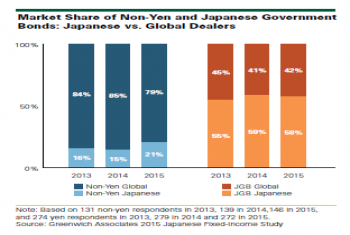

Nomura Securities dominates both cash equity trading and research/advisory services.

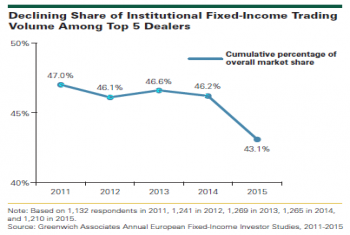

The competitive positioning of Europe’s leading fixed-income dealers is increasingly defined by regulations and banks’ strategic responses to new rules that have altered the economics of the business.

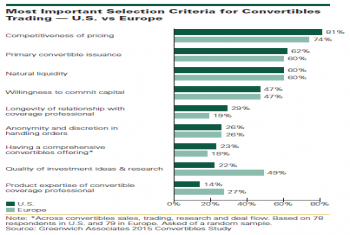

Brokers globally are battling for potentially lucrative trading business in options & volatility products, equity swaps, equity futures, and convertibles compete on the basis of pricing, willingness to commit capital to trades, their own...

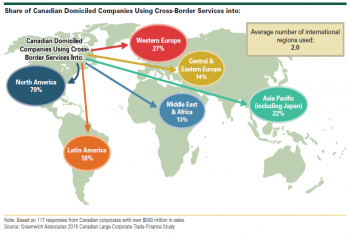

Banks competing for the business of Canada’s largest companies are navigating a changing market.

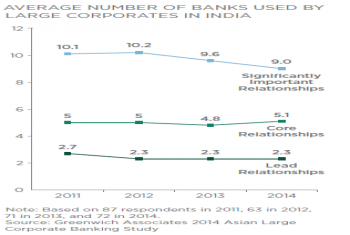

Domestic banks in India have been closing the qulaity gap and winning key spots on Indian large corporates' bank lists.

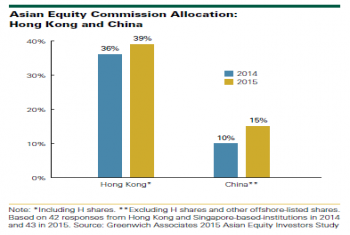

Fierce competition for trading share among Asian equity brokers.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder