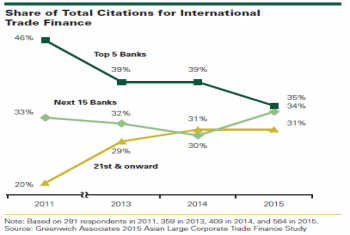

New Regulation Benefits the Top Banks with Larger Share

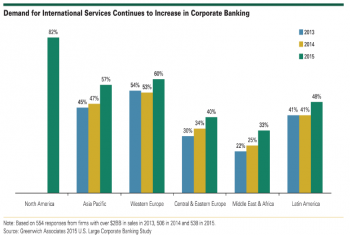

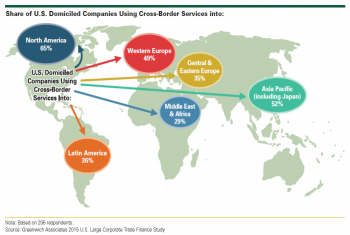

U.S. corporates increase concentration of banking business in the hands of the market’s biggest banks.

U.S. corporates increase concentration of banking business in the hands of the market’s biggest banks.

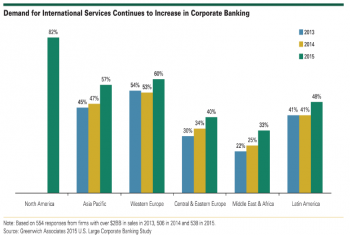

European companies are lowering costs and simplifying operations by consolidating trade finance for transactions in their home region.

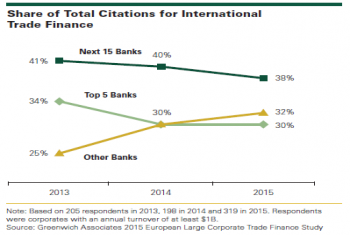

The biggest banks are expanding their trade financing and servicing footprints to support U.S. companies.

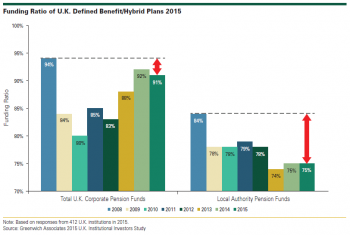

U.K. pension funds continue to search for answers to their ongoing underfunding problem.

Equity brokers in the emerging markets are rewarded for consistency.

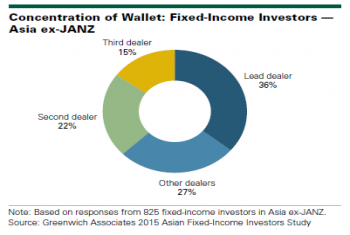

Asian fixed-income trading volumes declined from 2014 to 2015, driven mainly by a 9% reduction of trading activity in Asian credit products.

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers.

Large companies across Asia have a ready supply of trade finance credit across the region.

There is only one story in Canadian fixed income this year, and that story is BMO Capital Markets.

Nordic institutions adapt to persistently low interest rates by seeking out sources of badly needed return.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder