Buyer’s Market For Asian Companies Seeking Credit

Competition among a large and diverse group of banks has created a buyer’s market for companies in need of credit and other banking services.

Competition among a large and diverse group of banks has created a buyer’s market for companies in need of credit and other banking services.

Large European companies are turning to foreign banks specializing in specific international markets.

While total notional volumesremained relatively flat, volumes among third-party distributors jumped over 50%.

Japan’s large equity brokers are capturing considerable market share with foreign investors active in Japanese equities.

In a time increasingly defined by the implementation and consequences of new regulations, Deutsche Bank has established itself as the leader in global fixed- income trading market share, while J.P. Morgan and Citi have distinguished themselves by...

Many global banks have pulled out or scaled back their coverage of Asian local currency bonds, leaving these fast growing markets largely in the hands of a few committed global banks like HSBC and Standard Chartered Bank and up-and-coming...

While total notional volumes in U.S. retail structured products remained relatively flat, only declining about 3% from 2013 to 2014, volumes among third-party distributors jumped over 50%. Retail remains by far the largest channel for retail...

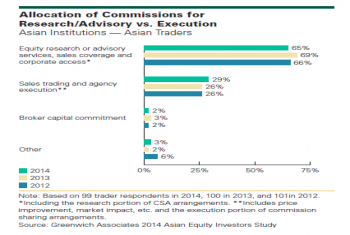

Bank of America Merrill Lynch and CLSA Asia-Pacific Markets are the top brokers in Asian equity trading for 2014.

BNP Paribas, Deutsche Bank and HSBC are used as a provider by nearly 30% of large European corporates that employ trade finance services.

Canada’s biggest banks retained their tight grip on the mergers & acquisitions, equity capital markets and debt capital markets business of the country’s larger companies as of mid-year 2014.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder