Quantifying Interest-Rate Swap Order Book Liquidity

For asset managers who act as a fiduciary for their clients, ensuring that they achieve best execution is not only important, but required.

For asset managers who act as a fiduciary for their clients, ensuring that they achieve best execution is not only important, but required.

Greenwich Associates presents best practices for meetings with investment consultants.

With the challenge of controlling all aspects of order placement across the 40 or so brokers that the buy side uses on average, venue-level TCA is a relatively new trend that is quickly gaining traction.

This research also details how trading desks allocate their technology budget to cover various expenses like terminals, hardware and OMS/EMS.

Despite the growing importance of e-trading and technology, the human touch is as important as ever. Today’s sell-side sales desk must provide proactive suggestions, understand market structure and offer clients advice on how to best leverage...

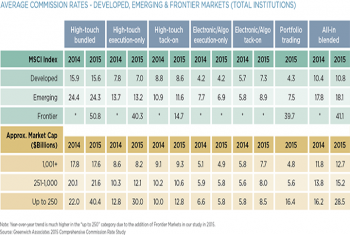

Despite regulatory reforms, volatile markets and debate about potentially radical changes to market structure, “headline” commission rates paid by institutional investors on global equity trades held steady from 2014 to 2015.

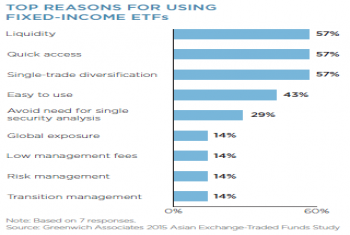

Exchange-traded funds (ETFs) have established themselves as important components of Asian institutional investment portfolios.

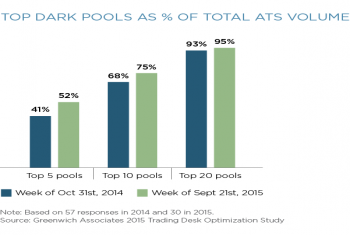

Dark Pools: Losing their Luster

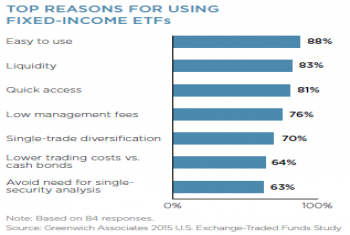

ETFs are becoming a staple of European institutional equity portfolios.

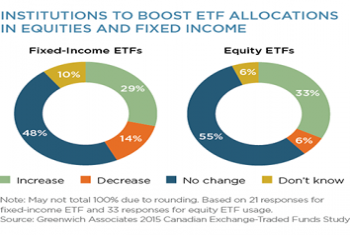

Canadian institutions rank as some of the most active and sophisticated ETF investors in the institutional marketplace.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder