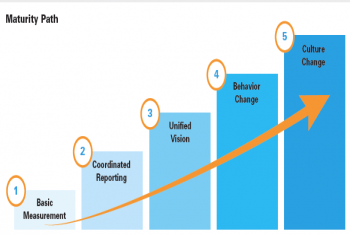

Greenwich Associates pinpoints steps dealers can take to mitigate and manage “conduct risk.”

Greenwich Associates pinpoints steps dealers can take to mitigate and manage “conduct risk.”

Enterprise feedback management platforms are emerging as powerful tools, but the task of selecting and implementing the right technology is only part of a much bigger and more complex strategic effort.

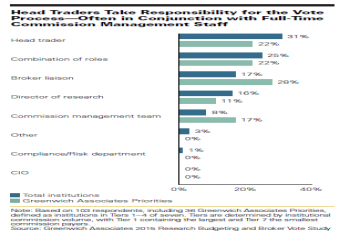

Given the current regulatory and market conditions, it's no surprise that everyone on both sides of the process is taking the broker vote more seriously than ever.

Ease of use, reliability and quality of support drive e-trading selection.

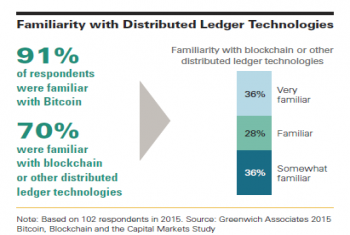

Blockchain technology presents a big opportunity for financial services firms.

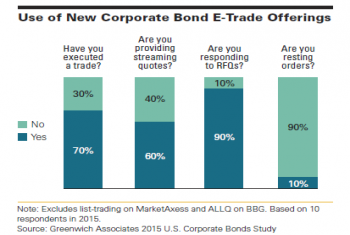

While investors' needs and wants are critical to the development of new liquidity pools, dealers must be economically incented to show up to the party.

New rules governing asset managers’ use of commissions to pay for research in Europe will have a dramatic impact on the industry, even if regulators stop well short of full “unbundling.”

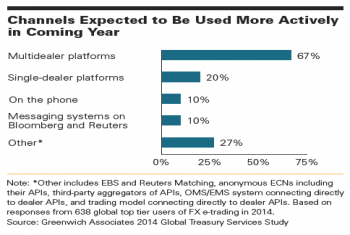

Market structure changes will spur growth in the share of volume trading through multidealer platforms in the coming years.

MENA companies should complement their bank rosters with locals as providers of credit and "high-touch" coverage.

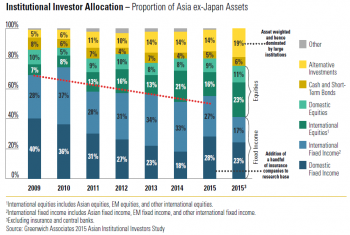

The decline in domestic assets in Asian portfolios in recent years has been as rapid and striking as the growth of institutional assets across the region.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder