Institutional Investment in ETFs: Versatility Fuels Growth

The growth in institutional investment in exchange-traded funds (ETFs) can be attributed to a single factor, versatility.

The growth in institutional investment in exchange-traded funds (ETFs) can be attributed to a single factor, versatility.

While gold has been a store of wealth for thousands of years, it received renewed attention following the financial crisis, as confidence in the banking system was shaken.

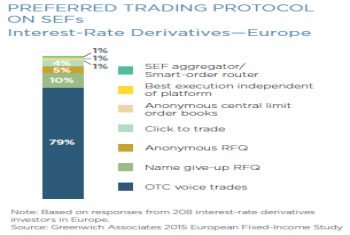

Electronic trading has changed the entire capital markets landscape. But the interest-rate derivatives (IRD) market has shown that despite quantifiable benefits of e-trading, institutional investors would still prefer to interact with...

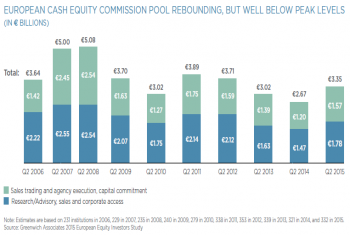

As Europeans brace for new rules, technology innovation will continue to transform markets globally.

In an unbundled world, the cost of execution may go up to the extent the real cost of liquidity has been obscured by bundling.

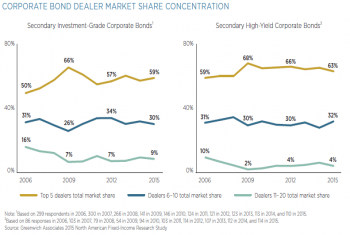

With nearly every active and semi-active bond trader in the U.S. is now online, demands for new methods of trading is changing the e-trading landscape.

Greenwich Associates identifies the similarities and differences between Small and Mid-sized businesses when it comes to their digital banking preferences.

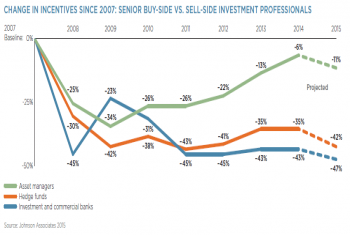

Recent good times for the buy side could be coming to an end.

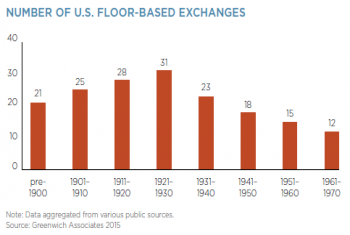

An examination of U.S. market structure shows an industry that is still coming to terms with the effects of its short courtship and hasty marriage with technology.

A game-changing, persona-based client segmentation model for the European institutional marketplace.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder